Mackay Insurance Blog

Cottage Insurance for Cottage Rentals: Are You Sure You Are Covered?

Recreational residences, also commonly called cottages here in Canada, are becoming more popular each year.

When our short but stunning summer season rolls around, vacationing gets a lot easier if you feel like a local at your destination. You can bring less, do more, and de-stress faster by vacationing at your own seasonal cottage.

But another reason cottages are becoming more popular is the rental income they can generate for their owners. Let’s say you open your cottage in late May and close it in early October. You spend one month in residence, and you rent out your cottage during the other three months.

It is easy to see how you can pick up a handy little chunk of change each summer just for renting out a space you already own!

There is just one catch: insurance. Did you know that most homeowners insurance policies prohibit rentals for more than one to two weeks, if at all? More than a few horrified cottage owners have discovered only after filing a major claim that they had voided their own policy by renting out their cottage!

You do not want this to happen to you. In this article, we take a timely look at the right type of cottage insurance to support you in renting out your cottage as often as you like.

Cottage Insurance “Deal-Breaker” Liabilities

There are some liabilities that may be just too big for your insurer to comfortably cover. Here are some general examples:

-

Permitting tenants to use your recreational vehicles (boats, ATVs, jet skis, etc.).

-

Providing life jackets for tenants (especially children’s life jackets).

-

Allowing smoking in or around the cottage.

-

Leaving your personal valuables in the cottage while it is being used by tenants.

Before you meet with your broker to discuss your cottage insurance needs for rental tenants, consider how you plan to present and market your rental cottage. For example, what amenities would you like to offer prospective renters that might give you an edge over other local cottage owners?

Review these with your broker to find out what your current policy will and won’t cover. Then you can talk about adding on riders or changing the type of insurance to fit your cottage rental needs and concerns.

Do You Need Homeowners or Business Insurance?

One highly relevant question for cottage owners who plan to rent their cottage frequently is whether homeowners insurance is enough.

Once you begin operating your cottage like a business, whether seasonally or year-round, this makes a strong argument to invest in the extra protection business insurance can offer you.

Here is one example: With a homeowners insurance policy, you may have some coverage for personal liability. Let’s say you are staying at your cottage and a neighbour walks over to visit with you and trips on your lawn. If that neighbour tries to sue you, you may have some personal liability protection under your homeowners insurance policy.

But now let’s say the person who trips on your cottage lawn is a rental tenant. They sue. Your homeowners insurance policy excludes coverage for business activities conducted on the premises of your personal seasonal residence. You have no protection!

This is a perfect example of how switching from homeowners to business insurance may make sense if you plan to rent out your seasonal cottage regularly.

Don’t Rely on “Host Guarantee” Policies from Online Rental Sites

One budding cottage entrepreneur discovered nearly too late that his homeowners insurance policy wouldn’t cover him once he began renting his cottage out through the popular Airbnb site.

Not only can renting out your cottage expose you to risk in the event of a rental-related claim, but also making such a claim may void your coverage entirely.

Perhaps surprisingly, insurers are concerned about pretty much the same things you are: crime, theft, vandalism, and liability.

While host guarantee-type policies, such as the $1M CAD policy the well-known rental site Airbnb offers, may cover you for certain types of damage or loss, it cannot be used as a substitute for your own cottage insurance. Here is why:

-

It covers only your liability if you are sued, not the cottage itself.

-

It does not cover your lost rental income while your cottage is being repaired.

-

It does not defend you or cover your liability if someone alleges that you assaulted them —even if you are completely innocent.

-

It does not cover or defend you if a claim is in any way connected to aspects of the construction of the cottage that you may not even know about if the work was done before you bought the cottage—for example, drywall from China or the type of primer that was used by a painter.

As well, it is important to know that the rental site may not necessarily be on your side in the event that you need to file a claim under a host guarantee. In the case of Airbnb, they will do their own investigation of the claim, which will initially delay claims processing.

They may also require you to attempt to resolve the dispute with your rental tenant before they will intervene or release payment for a claim. This can delay claims processing still further as well as add an extra layer of stress to the whole process.

Secure Your Cottage Rental with the Right Insurance

It is not uncommon for seasonal cottages in Canada to command anywhere from $1,000 to $4,000-plus per week in rental income. No wonder so many cottage owners are eager to begin renting out their cottages!

But without the right insurance policy, what looks like an easy way to generate income can quickly become a financial nightmare.

The only way to ensure your cottage investment is secure for both personal and business (rental) use is to contact your broker and discuss your options for cottage rental insurance.

Get in Touch

Is this the year your cottage is going to start paying for itself with seasonal rental income? Let us help you create a custom insurance policy tailored to your unique needs and cottage rental goals.

Contact us online or give us a call at 888-853-5552 to schedule your consultation!

5 Ways to Save on Home Insurance By Installing a Home Alarm System

How would you like to save up to 20 percent on your annual home insurance premium?

This is the estimated annual amount you could save each year by adding a home alarm system to your home security and safety tools.

Some of the savings you can realize are tangible, easy to calculate, and immediately translate into money back into your pocket.

Some of the savings are less immediately tangible, like peace of mind, safeguarding irreplaceable items and memories, feeling safe in your home, and also knowing your home is protected while you are away.

All of these savings matter. And with the help of a home security system, you can start reaping all of the following types of home alarm system-related savings right away!

How a Home Alarm System Helps You Save

Having your home or car robbed or vandalized is always heartbreaking, stressful, and unforgettable. For many homeowners, the sheer experience of having their private home space breached can cause symptoms akin to post traumatic stress disorder (PTSD) or major depression.

When you add to that the anxiety and expense of having to put your life and your home back together after a burglary, the expenses start to mount.

These five savings options are all available to you when you choose to install a home security system!

1. Save 5 percent just by adding a home alarm system.

Just adding any type of home alarm system, no matter how basic, can often net you at least a five percent discount on the cost of your annual home insurance policy.

2. Save 10 to 15 percent by connecting that system to a central monitoring network.

There are a few options today to provide you with extra safety and security monitoring inside your home for the times you can’t be at home personally to keep an eye on things.

These can include smartphone-managed remote tools, closed-circuit video monitoring or connecting your system to an externally monitored central network.

The latter often includes extra services, such as the option to generate a call to local law enforcement if the security alarm is tripped and unauthorized entry is suspected.

You can talk with your insurance provider about which types of networking options may provide you with an extra discount or reduction on your annual home insurance premiums.

3. Save even more by adding water sensor alarms and/or video monitoring.

Some insurers will provide a discount of up to 35% of the premium for water damage peril if you add a water sensor-monitored alarm. The more components of a full security system you add, the more you can save.

Alarms and sensors can include an automatic message sent to your cellphone and to local authorities. With video monitoring, you can immediately see what is actually happening inside your house if a smoke detector, intruder alert, or water sensor is tripped.

4. Save 10 to 15 percent for remaining free of claims for three to five years.

Sometimes the biggest win that comes from installing a home alarm system is simply by making your home a less desirable target for thieves.

If you wanted to burgle someone’s home property, would you choose a house that has a “Smile! You’re on Video Camera!” sign posted out front or a house that has no sign?

You would probably pick the house that looks easier to get in and out of without being detected, right?

This is why even the simplest home alarm system can end up being an effective tool to deter criminals. This is also why many home insurance providers are willing to offer homeowners a reduction in premiums for installing home alarm systems!

5. Save on depreciation costs for replacement of lost, damaged, or stolen items that have devalued or are simply irreplaceable.

Depending on how your home insurance policy is structured, you may have reimbursement of lost, vandalized, or stolen items based on their replacement cost, or you may have coverage only for their actual cash value. If you have an insurance policy that reimburses based on actual cash value, you should know that most items are reduced in value (they depreciate).

Keep in mind that even if your home contents are insured for their replacement value, some things in the home may not be. For example, if you have a car parked in an attached garage, that car is covered on its own vehicle policy, not on your home policy. Most car policies do not provide replacement cost coverage if someone breaks into your home and steals or vandalizes your car. Having an alarm can deter would-be thieves and protect things like your car.

By making your home less desirable as a target for thieves, you increase your chances of never having to file a loss or damage claim against your home insurance at all! Not only will this keep your most cherished items safely in your possession, but it will also net you the additional savings described here, depending on how your insurance provider’s safety discounts are structured.

Mackay Insurance’s Founder, the Late David Mackay, Recommends Home Alarm Systems!

Did you know that Mackay Insurance’s founder, the late and much-missed David Mackay, kept a home alarm system for many years and credited it with keeping his household safe and improving his own peace of mind?

You can watch Mr. Mackay share his story in this video: “How Alarm Systems Can Save You Money on Your Homeowners Insurance.”

Give Us a Call

Here at Mackay Insurance, we keep David Mackay’s legacy alive by keeping premiums affordable and customer service top-notch!

Today, Mackay Insurance has grown from a small local firm with just 35 clients to a regional brokerage serving the insurance needs of more than 5,000 residential and commercial customers!

Give us a call at 1-888-853-5552 or visit us online to get a free estimate on our insurance products!

Click here to get an instant, online, no obligation home insurance quote now.

Motorcycle Insurance: Is Minimum Coverage Enough?

Here in Ontario, if you ride a motorcycle you are required to have a valid motorcycle licence and carry motorcycle insurance. The same holds true if you drive a limited-speed motorcycle or moped.

Of course, just as with automobiles, the type of motorcycle you ride can impact what you pay for motorcycle insurance. So can your age, gender, rider training, driving record, driving patterns, and address.

No one loves paying for their insurance, and it can feel like you are spending money for something you never even use! To save on premiums, some people drop down to the bare minimum coverage. But if you do need to use your insurance, will the minimum motorcycle insurance coverage protect you adequately?

On the other hand, are you paying for coverage you do not need? Is there any way to drop or lower some coverage so you can use those savings to pay for coverage that is more important to have?

Read on to find out the answers to these timely questions about motorcycle insurance!

Minimum Required Motorcycle Coverage in Ontario

Each province is permitted to set its own minimum requirements for vehicle insurance. But in some areas of coverage, the minimum required coverage is absolutely not sufficient.

In Ontario, the current minimum required motorcycle insurance coverage is as follows:

Liability

Third-party liability coverage protects you if you are sued because you are involved in a motorcycle incident where another person's property is damaged or they are injured or killed. The legal minimum coverage of $200,000 is not adequate protection.

Accident Benefits

Statutory no-fault accident benefits provide protection if you are injured in a motorcycle accident. Coverage includes:

-

Income replacement of up to $400 per week.

-

Medical, rehabilitation, and attendant care coverage up to a combined total of $65,000.

-

Life insurance (if death results from a car or motorcycle accident) of $10,000 to a surviving dependent and $25,000 to a surviving spouse.

-

And other benefits

Direct Compensation for Property Damage

Called DCPD, this benefit protects you if you are involved in a motorcycle incident in which the other driver is at fault and that other driver has Ontario insurance.

Uninsured Motorist

This benefit protects you if you are injured in a motorcycle accident and the responsible other driver is not identified or not insured.

Should You Add Optional Coverage to These Basic Motorcycle Coverages?

Even a casual review of the minimum motorcycle coverage required for Ontario riders highlights areas where you need additional protection.

Every motorcycle owner should have increased coverage:

-

Increase liability coverage from $200,000 to a minimum of $1 million.

-

Review ALL available optional Accident Benefits coverages, and at a minimum increase the limit for Medical, Rehabilitation, and Attendant Care coverage.

Other optional coverages are personal decisions based on your specific circumstances. If you are a single person riding an older motorcycle, your coverage might look quite different than if you have young children at home and ride a $30,000 touring motorcycle.

Finding an insurance broker you trust is a key component of the selection process. You want to be able to talk openly about your situation without feeling pressured to purchase a specific level of coverage that you don't really need.

Ways to Save on Motorcycle Insurance Premiums

Many first-time riders pay more than they need to for motorcycle insurance.

Just as with auto insurance, driver training, bundling, the choice of bike, and how you pay, your other memberships and certain safety precautions can help you pay less for the same amount of insurance coverage.

1. Take a rider safety course

If you are a first-time motorcycle owner, a rider safety course is strongly recommended. There are courses that provide helpful safety training, and also a bike to ride for the training course and to get your M2 license. Get your M2 license before you rush out and buy a motorcycle that you will find it difficult or impossible to insure.

2. Bundle your insurance

If you already have auto insurance or home insurance, ask if you can get a discount by bundling in motorcycle insurance. Some insurance companies provide preferred prices on motorcycle insurance, but write motorcycles only if they also write the person’s car insurance.

3. Buy the right type of bike

Just as buying a sport automobile can mean higher insurance premiums, so too can some types motorcycles. Premiums, and which companies will even write the insurance, are different for a standard bike than for a high-performance or dual sport bike.

4. Pay cash for your bike

It goes without saying that if you can pay cash, you avoid paying interest. It also lets you decide what coverage you want to put on the motorcycle to protect it if it is stolen or damaged in an accident. If you borrow money to buy the bike, the lienholder will demand that you buy collision and comprehensive insurance.

5. Ask about discounts

Insurance companies may offer a discount for safety and anti-theft features, a clean driver record, being a senior, having a garage, and other things. Ask your broker.

6. Adjust your deductible

The deductible is the amount that you pay first if your bike is stolen or damaged. A higher deductible results in a lower insurance premium; a lower deductible results in a higher insurance premium.

Give Us a Call

Here at Mackay Insurance, we value each and every client we are able to serve. More than 5,000 people to date have trusted us to help them select just the right insurance coverage to fit their individual needs.

If you need help selecting motorcycle insurance, give us a call at 888-853-5552!

Ride Sharing Auto Insurance: Are You Protected While On the Job?

Ride sharing has become a big deal in recent years. Uber launched in 2009. EcoRide powered up in 2011. Lyft debuted in 2012.

More companies continue to join the ride-sharing revolution, and as they do they are recruiting more drivers to work part time or full time ferrying folks from place to place.

If you are currently working as a ride-sharing driver, you are likely using your personal vehicle. You may have assumed you were insured while on the job under your personal auto insurance policy. This is not necessarily the case.

Learn what you need to know to be protected while working as a ride-sharing driver!

What Is Ride Sharing?

Ride sharing is at heart a service industry. There are many benefits to the growth of the ride-sharing industry, from reducing roadway congestion and greenhouse gases to providing jobs and economical local taxi rides.

Ride sharing is essentially an arrangement between a driver and a passenger. The arrangement is made by using an app: this is how the driver and the passenger connect with each other. The app itself is managed and maintained by the company that hires the driver, and the driver typically uses their personal vehicle to transport the passenger.

In this arrangement, there are actually three parties involved in any ride: the driver, the passenger, and the ride-sharing company.

Does Your Ride Sharing Company Offer Commercial Coverage?

Ride sharing is a relatively new industry, and one which the insurance industry as a whole has been slow to recognize and respond to. In the meantime, ride sharing itself continues to expand, adding new service options on what sometimes seems like a daily basis!

While ride sharing has been available throughout North America for at least the past eight years, only recently did the Financial Services Commission of Ontario approve commercial auto insurance coverage for ride-sharing companies.

If you work for Uber, EcoRides, Lyft, RideCo, InstaRyde or Facedrive, the ride-sharing company provides a standard blanket commercial insurance policy provided by an insurance company.

If you work for another ride-sharing company, it will be up to you to talk with the company management and learn what, if any, commercial coverage protects you while driving on the job.

What About Your Personal Auto Insurance Policy?

Even though you have commercial coverage through your agreement with, say, Uber, you are still using your personal vehicle. That vehicle is insured by a regular insurance company when it is not being used for Uber driving and the fact that you do ride sharing must be agreed to by your personal insurance company.

It is critical that you talk with your agent or broker before you begin as a ride sharing driver. They may need to move you from an insurance company that does not allow ride sharing to one that does. And at this point, most insurance companies do not allow this use.

Making it even more complicated, your personal insurance company may allow use by one ride sharing company (e.g., Lyft) and not another (e.g., Uber). One of the reasons is that the insurance company covering your personal car needs to know exactly what the ride-sharing policy covers.

For example, let's say you are driving your vehicle on your way to pick up a passenger and you are involved in an auto accident. Who pays the claim? Are you a ride-sharing driver at that moment? Or are you a regular person until the customer gets into your car?

Your ride-sharing policy may cover you once you have received and accepted a ride request. But it may not cover you while you are waiting to receive a ride request or after you have received a ride request but before you have accepted that request.

In the same way, the ride-sharing policy may cover you while you are transporting your passenger. But the moment you drop off your passenger, and you are then waiting for another ride request to come in, you may not be covered.

Imagine the mess this could cause. Your personal insurance company saying you were working at the time an accident happened, and they won’t pay. Your ride-sharing insurance company saying you had not started working yet, and they won’t pay. In the meantime, your car is wrecked, or even worse, you are injured and have associated costs.

The only way for you to not be left with two insurance companies fighting over who should pay a claim is if they figure out the details in advance. That is why specific insurance companies who write the personal use of your vehicle have to go through what a specific ride-sharing insurance company does and does not cover, and agree to cover “the rest.”

Even though you make all your payments on time, you could get caught without insurance if you don’t work this out with your personal insurance company. The only way for you as a regular person to know that you won’t get caught without insurance is to talk with your agent or broker before you start doing ride sharing.

How Does Standard Ride-Sharing Coverage Work?

Okay, so you have talked with your broker. Your personal car insurance company is cool with you being a ride sharing driver with the particular ride-sharing company you have gone with. The ride-sharing company tells you that you are covered under their standard policy.

All is well, so time to stop worrying about insurance and go make some money. Right?

Well… almost right. Ultimately, making sure you have adequate auto insurance coverage in place to protect you while working as a ride-sharing driver is up to you. Even if your ride-sharing company does provide some type of standard one-size-fits-all insurance coverage to you as a contractor-driver, it may not be sufficient to fully protect you if you have an incident on the job.

For this reason, it is critical to read the fine print of the standard insurance protection issued by the ride-sharing company, so you know precisely what and how much coverage you have during the times you are covered while on the job. For example, what is the coverage and what is the deductible if your car is damaged? How about coverage if you are injured? Or if someone sues you?

The same important questions that you need to look at on your personal car insurance also apply to the commercial insurance you have through the ride-sharing company.

Get in Touch

If after reading all of this you are even more confused, give us a call or contact us online. The truth is that it is not simple. Bring in a copy of the insurance agreement from the ride-sharing company and let us help you understand the fine print on that policy.

Even though you do not get that insurance through us, helping people through mazes like this is exactly what we as brokers do. And we will be sure you are with a personal insurance company that allows ride-sharing with the ride-sharing company you are going with.

Here at Mackay Insurance, we help you understand what insurance you have and what you need. Give us a call at 888-853-5552 to learn more about ride-sharing insurance coverage.

Click here for a free, instant, online, no obligation auto insurance quote.

Do You Need Commercial Auto Insurance?

If you can’t imagine doing business without your vehicle, chances are good your livelihood would suffer greatly if that vehicle became unavailable due to an accident or loss.

Regardless of how many commercial vehicles you own (one or several), you need to protect them as valuable business assets.

Commercial auto insurance functions similarly to personal auto insurance in that you can select the types and levels of coverage that are the best fit for your business and vehicle types.

The goal of commercial auto insurance is to ensure your business vehicles are protected on the road and while garaged, whether your trips stay local or eventually cross borders.

In this article, learn the basics of commercial auto insurance and how it can protect the vehicles you depend on to do business.

An Overview of Commercial Auto Insurance Coverage

When most people think about commercial auto insurance, they often assume it’s designed only for large fleets of big trucks.

While this is one use for commercial auto insurance, it is far from the only use. In fact, if you have any vehicle that you use for commercial (business) purposes—even if you also use that vehicle personally—it is eligible for commercial auto insurance.

Commercial or business auto insurance offers the same basic types of protection that personal auto insurance covers:

-

Comprehensive coverage. Protection if your business vehicle is damaged by something other than a collision (e.g., vandalism) or if it is stolen.

-

Collision coverage. Protection if your vehicle is damaged or totaled in an auto accident.

-

Liability coverage. Protection if your vehicle causes damage to other drivers or vehicles.

-

Accident Benefits coverage. Protection if you are injured in a vehicle accident.

-

Uninsured/underinsured coverage. Protection if the other driver has no coverage or insufficient coverage.

Commercial Versus Personal Auto Insurance

It is quite common to be confused about what separates commercial (business) auto insurance from personal auto insurance. After all, they sound identical on paper!

The difference boils down to what you are using your vehicle for. Even if you use your vehicle for personal use as well, if you use it in your business too, it needs to be insured accordingly.

This holds true even if you don’t use your personal vehicle to do business frequently. One of the “declarations” you make when you buy car insurance is the percentage it is used for business driving.

So: what if you already have personal insurance and begin to use your car for business driving after you bought the policy? You need to call your broker. There is fine print in every car insurance policy that requires you to promptly inform your broker or insurance company of any “material change.”

This means that if you don’t report the use of your car accurately, you could find yourself paying for a policy but not having coverage when you have a claim. It just isn’t worth the risk.

If you are not sure if what you do with your vehicle is considered business driving, call your broker.

How to Save the Most on Your Commercial Auto Insurance Policy

No one really gets excited about spending money on insurance. This is because purchasing insurance is not a luxury but a necessity. One terrible day on the road has the potential to make or break a business of any size, and that is a risk businesses can’t afford to take in today’s competitive marketplace.

But there are ways to pay less for your commercial auto coverage!

Here are some of the best methods to find discounts and savings on your commercial auto insurance policy:

-

Bundle your policy with other policies you hold with the same insurer. Some insurers offer loyalty discounts for customers who purchase more than one type of policy.

-

If employees drive your vehicles, look at applicants’ driving records as part of your screening process when hiring people. It’s simple: drivers with excellent safety records and no tickets on their record are less expensive to insure.

-

Choosing to install extra safety or risk management tools. These can range from in-vehicle alarm systems to driver monitoring systems, locked garaging to VIN etching, mandatory driver safety courses for your drivers, or daily mileage limits.

-

Check auto insurance coverage rates before investing in a new work vehicle. Just as with personal vehicles, in the business world, different types of vehicles may come with lower or higher premiums.

Give Us a Call

We are so honored that our owner and CEO, Bruce Mackey, was named 2017 Business Person of the Year by Quinte Business Achievement Awards (QBAA)!

Give us a call at 888-853-5552 or contact us online, and let us know how we can help with all your insurance needs in 2018!

Click here for a free, instant, online, no obligation auto insurance quote.

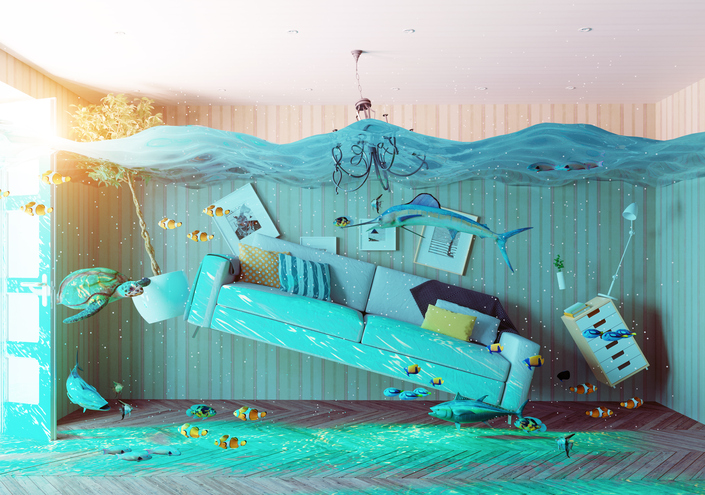

Do You Have Sufficient Flood Insurance Coverage? Know For Sure

This year has seen a tremendous amount of rain and hurricane activity south of our borders. Our friends in the United States have been buffeted by storms that broke records for rainfall, wind, and mass destruction.

But what is so amazing is that an estimated whopping 80 percent of homeowners in Hurricane Harvey's path alone didn’t have any form of flood insurance!

Those homeowners who didn’t have flood insurance now rely on government aid and private grants to help them rebuild their homes and lives. This makes for a timely reminder for Canadian homeowners to review policy coverages and make sure there are adequate protections in place.

Did You Know Flooding Is the No. 1 Naturally Occurring Threat in Canada?

If you are like many of our clients, you may not be aware that flooding is the most common natural disaster to strike Canadian homeowners. In fact, flooding has now overtaken fire as the most prominent risk faced by homeowners throughout Canada.

The reasons that flooding has become more severe of late vary. There are climate changes and warmer weather year-round. In many areas throughout Canada, outdated sewage systems and public works infrastructure can cause backup into basements and first-floor housing. New subdivisions are popping up on former swampland—and guess where the water still naturally runs!

In 2013, large portions of Calgary and other Alberta cities like High River were literally under water. A few weeks later, a record-breaking series of storms created flash flooding throughout the city of Toronto and surrounding boroughs. The 126-mm (4.9-inch) rainfall exceeded even that produced by legendary 1954 Hurricane Hazel, and meteorologists do not make light of this trend. These 2013 events also accelerated the Canadian conversation about flooding and insurance.

Flood Insurance: What It Is & What It Isn't

Until very recently, the only recourse for Canadians whose homes were damaged or destroyed by flooding was to submit a claim to Disaster Financial Assistance programs on federal, provincial, and territorial levels. But even with this recourse, in most cases proffered funds have not been sufficient to bring homeowners back to break even.

When polled, most Canadians reported one of three assumptions:

-

They thought they didn’t need flood insurance coverage.

-

They thought their homeowner’s insurance policy automatically covered flooding.

-

They thought they could get sufficient reimbursement from government-sponsored disaster relief agencies.

Unfortunately, not one of these three assumptions is accurate. Most homeowner’s insurance policies specifically exclude flooding.

Wait a minute, you may say. My neighbor had a flood in her house when the water line to the ice maker in her fridge sprang a leak and ran all weekend while she was away, and her insurance company fixed things right up for them...

But here is the most important part of this post: there are all sorts of different types of water damage. Some are covered on your policy. Some are not.

Most insurance policies give you the coverage you need to clean up the damage if a pipe bursts or a washing machine hose fails. Your policy would probably also cover water damage that resulted from a storm lifting shingles or, say, hail hammering your siding. If you purchase an optional rider, your policy would also cover your sewer or septic backing up.

What you did not have prior to 2015, though, because homeowner’s policies in Canada did not cover this peril, was flood coverage.

Overland Water/Flood Insurance: A New Homeowner’s Insurance Product

Beginning in around 2015, Canadian insurance companies began to offer a new type of water damage coverage—flood insurance. Many homeowners didn’t know they didn’t have it in the past, and some still don’t have it. Those who do have it may not know what it does and does not cover.

To know what coverage you do and do not have, you will need to know the meaning of an insurance term: “overland water damage.” This is damage caused by a body of fresh water (such as a lake or stream) overflowing its banks and water literally flowing “over the land.” Overland water damage can also happen when there is no creek but the rain is so heavy that it accumulates and makes its own creek. This is the coverage that a number of insurance companies have brought out recently.

It is important to know that Overland Water is just one of the ways flooding can happen—for example, a dam could burst or an underground stream could cave in the foundation of your house. Even though flood insurance is now available, not everything is covered. Every policy is different in exactly what it covers. Some types of flood damage are still not covered by any policy—for example, a tidal wave wiping out a shoreline community. Some insurance companies still do not offer flood insurance at all, though most now do. And for insurance companies that do offer flood insurance, there are differences between what one insurance company covers and what another one covers.

So how are you as a homeowner supposed to navigate these “waters”? One step is to assess what you need. Your needs are different if your house is on top of a hill or if it is waterfront property. However, don’t assume that only people who can throw a stone from their deck and hit a lake or a stream need flood insurance. Almost everyone faces some level of risk. A second step is to talk with an insurance professional about what coverage you need, what coverage you do or don’t have now, and what your options are.

Why Applying for Flood Insurance Is Now Critical

Before 2015, any homeowner who experienced flood-related home damage was eligible to apply for government aid.

But now that many insurers have started to offer flood insurance products as homeowner's insurance policy riders, eligibility standards for federal, provincial, and territorial disaster relief assistance are changing accordingly. Specifically, if you as a homeowner qualify for flood insurance and don’t know about it or choose not to apply, you may now be deemed ineligible for government aid in the wake of flooding. This leaves you without recourse in the event your home is damaged or destroyed by flood waters.

Weather Pattern Predictions in Coming Years

The federal government of Canada has now begun to study future weather-related risks in earnest. Steadily rising costs for annual federal disaster relief funding to various affected areas throughout Canada speak loudly of the need to revise policies and budgets for weather events in years to come.

For example, in 2004, the federal government paid out approximately $54 million in storm relief funds. In 2014, that number had risen to $410 million! Starting in 2017, the estimate jumped again to $673 million—and that is just for flood damages!

Key areas for further investigation include rising sea levels, glacial melting, erosion of coastal areas, flooding from storm surges, and related storms and severe weather event activity.

While certain parts of Canada are experiencing more rapid climate-related changes than others, there is no doubt at this stage that climate change has arrived and is here to stay. This requires action on everyone’s part, from individual homeowners to strategizing at the national level for how to afford flood insurance coverage for everyone who needs it.

Give Us a Call

If you are concerned about the risks of flood damage to your home, Mackay Insurance is here to help. We can set up a time to review your current homeowner's insurance policy coverage and riders, re-evaluate coverage levels, and discuss optional flood insurance coverage based on the risk level to your area.

Give us a call at 888-853-5552. You can also visit us online to chat with a broker live or send us an email.

Click here to get an instant, online, no obligation home insurance quote now.

What is Claims Protection on Insurance?

A transcript follows below the video...

What is claims protection?

Claims protection is like a get out of jail free card for your first at fault accident.

In the event that you have an at fault accident, your driving record will remain the same, and you will not see an increase in your premiums due to that at fault accident.

This is an optional coverage that you must purchase in order to have on your coverage.

Please give us a call, or email us to discuss it further.

What is Optional "Bylaws Coverage" on your Homeowners Insurance Policy?

A transcript is available below the video...

You should consider adding bylaws coverage to your homeowners insurance policy.

What is Bylaws coverage? What is a bylaw?

Well, in some towns and municipalities they put an extra expense, or they ask you to build something bigger, better, or safer than you actually had in the first place. In some cases this will add expense, or an extra cost, to the reconstruction of your home.

For instance, let's say you have an 800 sqaure foot home. Your municipality in which you live says, "We're not allowing you to build anything less than a 1,000 square foot home". The difference that is incurred, is going to be incurred by you. Your insurance policy won't pay for any extra expense that comes out of an extra bylaw that your town puts upon you.

So, if you have an extra bylaws coverage endorsement, it will allow you to offset that expense for the extra construction cost. It's minimal, it only costs about $10 or $20 extra, and it could save you a lot in the long run.

So, if you want more information, please call your CSR, or give us a call at the office.

Click here to get an instant, online, no obligation home insurance quote now.

How Alarm Systems can save you money on your Homeowners Insurance

Transcript follows below the video...

I would strongly recommend that you would consider putting an alarm system in your home. I've had one in my own home for many years and there's a peace of mind factor that you cannot buy.

As well, you would get a discount on your insurance if you have a working alarm system in your house.

It would prevent claims and prevent having something stolen from your home that you cannot replace.

Click here to get an instant, online, no obligation home insurance quote now.

Protect Yourself from Identity Theft with Homeowners Insurance

The term "identity theft" makes normal, sane adults quake in fear. Statistics support that the fear is well-founded. Not only is identity theft increasing throughout Canada, but it is increasing rapidly.

The Government of Canada's Competition Bureau reports that, as of 2017, Canadians have lost nearly $300 million to identity theft in the past two years!

Complaints of identity theft lodged with the Bureau increased from 70,000 to 90,000 in just 12 months. That is a 28% increase and an additional 20,000 victims in just one calendar year!

Why do we bring this up here and now? For two reasons:

-

You, just like every Canadian, are at risk no matter how careful you are

-

Your homeowners insurance policy may be able to offer you protection against identity theft.

How Identity Theft Happens

If only there was just one way that identity theft could occur! We could all protect ourselves against that method. Unfortunately, identity theft scams are becoming more devious every day. From outright physical mail theft to online phishing, from email trickery to phone surveys, identity thieves can be remarkably patient. They collect small pieces of the sensitive data required to insert themselves into your financial life—and with disastrous results.

It is common for identity scammers to start with small thefts and work their way up. If the small scams remain undetected, they will continue to chip away at your identity toward a much larger theft.

How to Protect & Monitor Your Identity

We highly recommend these simple tips to monitor and protect your identity on an ongoing basis:

-

Always shred any document with your name, address, phone number, or any sensitive personal information printed on it—even junk mail!

-

Collect your physical mail daily so identity thieves don't have a chance to get to it first.

-

NEVER give ANY personal or financial information to ANYONE whom you do not know AND trust—whether this is over email, phone, fax, text, chat, or any other means.

-

Guard your online identity like a hawk. This includes passwords, personal PIN numbers, social media contact information, photo/video location tagging, and any other place you go online.

-

Regularly change your passwords and personal PIN numbers. Make the new ones sufficiently complex that you have trouble remembering them (if you struggle, chances are good identity thieves will struggle too!).

-

Use an encrypted password keeper program or app to store this type of information for your personal use.

-

Do not allow online e-commerce portals to remember your credit card data for future transactions—shopping online as a "guest" is the safest option.

-

Review your banking and credit card use transactions frequently (weekly or more frequently is ideal) and immediately follow up on any unknown or suspicious-appearing transactions.

-

Monitor your credit report and credit score at least once or twice annually and look carefully for discrepancies.

You can also monitor the Competition Bureau's Consumer Alerts webpage to be aware of newly identified individual and business scams.

How Homeowners Insurance Can Protect Your Identity

Here at Mackay Insurance, our clients are sometimes surprised to learn that their existing homeowners insurance policy can also offer protection from identity theft. Our new clients, of course, are delighted by this news!

How can homeowners insurance protect your identity from thieves? The term "identity theft insurance" can be confusing. Let’s use the example of unauthorized credit card purchases to understand the two separate problems that identity theft causes. First, the thief has used your credit card information to pay for their $3,000 vacation. If you follow the procedures from your credit card company, those charges on your credit card can usually be reversed.

However, you now have a second and potentially bigger problem—and this is where your home insurance coverage can help. Someone out there has your identity.

- You may need to notarize fraud affidavits for law enforcement agencies. That costs money.

- You may need to notify government agencies or financial institutions by registered mail.

- You may need to take time off work to talk with people who are available only during your work hours, and this can cost you lost wages.

- You may need to pay fees for new loan applications.

- You may actually end up being sued by someone who was defrauded by the identity thief while they were pretending to be you. Legal expenses can add up quickly.

It is mostly in this second category of expenses (getting your identity back) that your home insurance policy can step in and help you.

As with any insurance, here are some important things to look at with identity theft insurance:

-

What is the amount the insurance company is insuring you for?

-

What events (perils) does the insurance company cover?

-

What is the deductible (the amount you need to pay if you have a claim)?

-

What do you need to do? With identity theft insurance, there is usually a requirement that you work with law enforcement and do the reasonable things you can do, such as cancel the compromised credit card.

-

What are the exclusions? This is sometimes called the “fine print” in the policy. It is not actually in fine print—and it is one of the most important parts of an insurance policy for you to understand. For example, with identity theft coverage on your home insurance policy, identity theft arising from your business pursuits are usually excluded. If you run a business, call us about separate identity theft Insurance for your business.

More About Mackay Insurance

Here at Mackay Insurance, we just celebrated our 40th anniversary! Over this time, we have grown from a tiny firm with just 25 clients to a thriving multi-location insurer with 5,000+ happy clients!

We are passionate about helping our clients guard against identity theft with the right insurance. Visit our video library for an informative video about homeowners insurance protection from identity theft and many other useful topics! Or just give us a call at 888-853-5552 to learn more.

Click here to get an instant, online, no obligation home insurance quote now.

Choosing the Right Cottage Insurance

Canada is an undeniably stunning country. We are rich in natural beauty, with a whopping total of 44 national parks to enjoy nationwide!

But most Canadians know you don't have to visit a national park site to relish our wondrous landscape—which also explains our zeal for owning seasonal second homes, often known simply as "cottages."

In fact, many Canadians are so keen to own a cottage they would be willing to cut their spending, go in with others to make the purchase, buy a "fixer-upper" place, or even just buy the land now and save to build on it later.

But once your dream cottage is finally yours, you also need to make sure you protect it. That is where knowing how to choose the right type of insurance policy is essential.

As the warm season approaches, these tips can help you evaluate your existing cottage insurance policy or select a new policy for the cottage you just purchased. If you find you have questions or need help picking a policy, we are happy to be of assistance!

Key Questions to Ask Yourself

If you have just bought your first cottage, you may not be sure yet how to answer some of these questions. But your answers will be important to determine what type of insurance and how much insurance you need, so think through these questions.

How often do you plan to visit your cottage?

If you plan to visit the cottage every weekend during the warm season, you may find your insurance premiums are lower than if you visit only occasionally. This is because you will be able to keep a much closer eye on your cottage and perform minor maintenance before a small issue turns into a big issue.

Do you plan to rent it out to other tenants?

Different insurers have different approaches when a cottage owner wants to list their seasonal property for rent. In most cases, if you have a fire alarm installed and you have a local person who is willing to check on the property before and after each short-term tenant visit, you will find coverage to be more affordable (although still higher than if you are the sole occupants).

As well, if you plan to rent to only people you already know, you may pay lower premiums than if you plan to rent your cottage out to strangers.

Some insurers place a cap on the number of weeks per year that a cottage owner can rent out their property, while others do not. In some cases, choosing a commercial insurance policy rather than a residential secondary home insurance policy will give you the coverage you need to earn extra rental income on your cottage and enjoy peace of mind that you are properly insured.

Do you intend to keep your cottage open year-round?

Insurers typically offer lower rates to cottage owners who have year-round road access to their cottage. This is mainly because of fire risks. If a cottage catches fire and there is no way to get to it during the cold season, claims will be much higher.

Of course, if your cottage doesn't have a road that is accessible year-round, you may still be able to get lower rates if you can find someone who lives in the area to check on it during the cold season. Installing a fire alarm can sometimes also help keep rates more economical.

Will your cottage serve as your primary or secondary residence?

In most cases, cottage owners declare a cottage as a secondary residence at least until they retire. In this case, often cottage owners will choose to add the cottage to their primary residence insurance policy as a seasonal or secondary residence.

If you do declare your cottage as your primary residence, you will have the usual tax advantages, as with any primary residence. In this case, you would need a full homeowner policy rather than a seasonal property policy.

Rider Options for Your Seasonal Insurance Policy

Most seasonal cottage insurance is issued on a named perils basis as opposed to all-risks coverage that is available on a comprehensive (primary residence) insurance policy.

The term "named perils" means there is a list of specific perils you are purchasing insurance to cover, such as fire, smoke damage, theft, or vandalism.

Depending on your cottage location and unique situation, adding on these riders may also make sense:

-

Animal damage. Large, hungry wildlife such as bears or small, hungry wildlife such as raccoons can inflict a surprising amount of damage on an unattended cottage.

-

Water or flood damage. Burst water pipes or sewer pumps or flood damage typically isn't covered in a standard seasonal cottage policy, but it may be available for an additional premium.

-

Cottage contents insurance. If you plan to leave certain high-value items at your cottage (rather than taking them back and forth with you, which would keep them covered under your primary homeowner's policy), you may want to purchase additional contents insurance coverage.

-

Recreational vehicles or watercraft. If you plan to store boats, jet skis, off-road vehicles or other recreational-use vehicles at your cottage, talk to your broker and be sure they are correctly insured.

-

Storage sheds or detached spaces. If you have additional storage units or shelter sites for boats or off-road vehicles, check to be sure your seasonal insurance policy offers sufficient coverage for these as well.

Contact Mackay Insurance for Help

Cottage insurance, like any other insurance policy, comes with its own terminology and learning curve.

While it can take some time to understand the ins and outs of this specialized insurance product, the ongoing peace of mind you get from buying the right policy that fully protects your cottage investment is literally priceless.

Contact us for help today!

Click here to get an instant, online, no obligation cottage insurance quote now.

4 Home Insurance Policy Types: How to Know Which One to Choose

If you can imagine it happening to your home, there is a good chance it can happen. This is what the home insurance industry is all about.

Home insurance exists for one reason: to protect the single biggest investment most people ever make.

Buying home insurance is not a legal requirement in Canada, but if you have a mortgage, the mortgagee will require that you insure the home. Whether or not you have a mortgage, the possibility of losing perhaps your largest asset is too great a risk to assume—thus, virtually everyone who owns a home carries insurance on it.

Not all home insurance policies are equal. In this article, learn about the four main types of home insurance policies and how to know which is right for you.

Type 1: Comprehensive Policy

If you are looking for the best coverage for both your house and the things inside it, you are looking for a Comprehensive policy. Not surprisingly, this is typically the priciest type of home insurance policy. In simple terms, both your house and most typical contents people have in their homes are insured against “All Risks.” This means they are covered for anything that could happen to them, unless a “peril,” or type of loss, is excluded on the policy.

Uninsured Perils

All insurance policies, even the most complete policies available, have some things that are not covered. For example: if you intentionally damage your own things, or if war breaks out, there is no coverage. With a Comprehensive, or All Risks, policy, it is important to review the things that are “not covered.” The good news with a Comprehensive policy is that if a peril is not on that “not covered” list—then it is covered.

In some cases, you can purchase additional insurance policies or riders to cover some uninsured perils. Flooding, earthquakes, and sewer damage are examples of uninsured perils that can potentially be covered under additional policies or riders.

Other uninsured perils are simply not insurable, such as terrorism, criminal behaviour on the part of the policyholder, or home issues deemed to be the result of maintenance left undone.

Insured Perils

Most of the common perils are not excluded on a Comprehensive policy, and again, if it is not excluded, it is covered. Though you will not see a list of what IS covered, common things like fire damage, theft of contents, smoke damage, water damage from a burst pipe, lightning strikes, wind or hail damage, and vandalism are not excluded and are therefore covered.

Type 2: Broad Policy

A Broad homeowners insurance policy gives you the same All Risks coverage on your house as a Comprehensive policy does. The only difference is that the coverage on your contents is reduced to “Named Perils” coverage. This type of policy is generally a little less expensive to purchase than a Comprehensive policy.

What does this mean for your belongings in your house? In simple terms, the policy will have a list of Perils that your contents are insured against. If a peril, or a cause of loss, is on that list, then there is coverage. However, if a peril is not on that list, then there is no coverage.

The list of perils that a policy like this covers your contents for is actually quite broad. Many of the common perils, like fire and theft, are covered on either a Comprehensive policy or a Broad policy. However, consider something unusual—for example, a deer wanders into your attached garage, becomes confused, and enters your house when the door opens (this has happened!). Once inside, it becomes disoriented and damages your contents before it finds its way back out. Is the damage it causes covered?

-

Under a Named Perils policy, it is covered only if one of the listed Perils is “damage caused by a deer.”

-

Under an All Risks policy (Comprehensive), it is covered—unless there is exclusion removing coverage for “damage caused by a deer.”

That is the difference in a nutshell between All Risks coverage and Named Perils coverage.

Now, the above example of the deer in the house is an unlikely situation. In practice, the more common perils are covered under either a Comprehensive or a Broad policy. Because of this, the price of the two policies is often quite close.

If you are presently insured on a Broad policy, you should check with your broker if you qualify for a Comprehensive policy and what the additional premium would be. You might be pleasantly surprised how little it costs to move from a good policy (Broad Form) to the best policy (Comprehensive Form)!

That said, a Broad policy could be a great solution for a cottage that is more like a second home, where the concern is more about getting the best available coverage on the building than on the contents.

Type 3: Basic (Named Perils) Policy

As its name suggests, a basic homeowners policy is one that outlines precisely what is covered. The coverage that is provided on both the building and the contents is “Named Perils”—a peril has to be on the list of what is covered or there is no coverage.

This type of policy may be a good fit for homeowners who are willing to take on some financial risk in return for a lower premium payment. It may also be the best coverage available on a second home or an older building.

Type 4: No Frills Policy

A no frills policy is a policy designed for “special needs” houses—in other words, houses that have some type of structural defect or issue that would ordinarily make them ineligible for home insurance.

If you own a property of this type, such as a fixer-upper that you are working toward restoring or flipping, a no frills home insurance policy can protect it until you repair it and it qualifies for regular home insurance. This type of policy is sometimes called a “Basic Fire policy” because the perils that are insured are limited to fire damage and a few other very basic coverages.

Additional Home Insurance Coverage You May Need

Even if you opt for a Comprehensive policy, you may still need additional coverage depending on your home’s geographic location, high-value personal possessions, and/or a home-based business.

Water Damage

Sewer or septic back-up coverage usually must be purchased as a separate coverage. If your home is situated in an area that has a high risk of flooding, you will likely want to purchase additional flood insurance.

High-Value Personal Property

Also, if you have valuable items (stamp collection, jewelry, artwork, furs, vintage antiques, etc.) at your home, your regular home insurance typically will cover these items only up to a certain value. You will want to talk with your broker about a rider to cover these items.

Home-Based Business

If you run a business out of your home and store equipment, supplies, or inventory there, be sure to talk with your broker about adding coverage for these items as well.

You may also want to take out a business insurance policy separately to cover the needs of your business.

Actual Cash Value Versus Replacement Cost

Your homeowners insurance policy will pay a claim according to one of two different methods. Regardless of which policy you have, it is important to know which method your policy will use.

-

Actual Cash Value. This method reimburses you for damage or loss based on the actual value of the item at the time it was damaged or lost.

-

Replacement Cost/Value. This method reimburses you for damage or loss based on what it would cost you to repair or replace that item based on current prices.

Not surprisingly, it will cost you more to have your house and possessions covered based on replacement cost/value. But if the unthinkable happens and your home is destroyed by an insured peril, you want to be sure your coverage will be sufficient to rebuild your home and replace your possessions.

How to Choose Your Home Insurance Policy

Before you assume you can't afford as much coverage as you truly need for total peace of mind, don't forget that there are ways to get discounts on your premiums. Give our knowledgeable insurance experts a call. We can help you find the best coverage to suit your needs. As brokers, we work with many different insurance companies and will help find you the best coverage that is available within your budget.

Click here to get an instant, online, no obligation home insurance quote now.