Mackay Insurance Blog

Cottage Season Is Nearly Here: Is Your Cottage Protected?

Victoria Day weekend, aka cottage-opening weekend, is around the corner!

This is a great time to refer to your cottage-opening checklist and start getting your game plan together. After all, the less time you spend actually opening your cottage, the more time you can spend enjoying it.

One key item it is so easy to overlook is insurance coverage. It may not be the most exciting part of opening up your cottage for the season, but it sure comes in handy if anything goes wrong!

In this post, learn what you need to know to determine if all of the coverage you need is in place.

3 Important Types of Cottage Insurance Policies

Of course, you want to have cottage insurance in place to protect you and your guests while you are on-site and to protect belongings and premises when no one is there.

But this isn’t the only type of cottage insurance you need to consider, especially if you keep valuable property or vehicles there or you have guests or tenants.

Cottage insurance

Your main cottage insurance policy protects your cottage itself, its contents and the surrounding property. It also protects you if a visitor experiences a mishap while on your property and decides to sue.

What many cottage owners do not realize is that their cottage use habits can impact how much they may pay for a standard cottage insurance policy.

Closing your cottage versus keeping it open year-round is another decision that can change what you pay for cottage insurance.

Declaring your cottage as a secondary residence can impact both your cottage insurance rates and the coverage that is available. Cottages that are actually regularly used “second homes” may be eligible for broader coverage.

We have written a detailed blog post about choosing the right cottage insurance that can help you think through the types of standard coverage and protective insurance riders you need in advance of the start of cottage season.

Tenant insurance

If you plan to rent out your seasonal cottage to tenants for part or all of the summer, or if you want to allow friends or relatives to stay for extended periods when you are away, you may need more than just a standard cottage insurance policy for protection.

A basic cottage insurance policy may allow limited use by other people. Before loaning or renting your cottage to others, you should call your broker to determine what your specific policy allows and arrange the correct coverage for the actual use of the cottage. Talk to your broker specifically about what goes with the cottage when you rent it out – for example, the use of a boat or an ATV.

If you do plan to start renting out your cottage, our knowledgeable brokers are happy to talk with you about your plans and protection needs before the season begins in earnest.

Recreational property or vehicle insurance

Recreational vehicles can include motorized boats, ATVs, classic cars, mopeds, motorcycles, jet-skis, trailers and trailer hitches, RVs and others.

If you store recreational (seasonal) property or vehicles on-site at your cottage or off-site, be sure insurance is in place before using them. You may need to reinstate full insurance on a vehicle that is used seasonally. If your insurance or plates renewed over the winter, remember to get the updated pink cards in each vehicle and tags on each license plate.

Making sure you have correct insurance in place for each recreational vehicle is important both for your own safety and for that of guests who may also use these vehicles during their stay at your cottage. It is particularly important to discuss with your broker the rules around other people using your vehicles. A standard vehicle policy does not allow you to “rent that vehicle out” to another person as part of a cottage rental.

Save Money By Reviewing Your Current Cottage Insurance Policy

We always recommend taking a few minutes each year to review your active insurance policies with your Mackay Insurance broker.

Be sure to talk through these important points, which may lower your cottage insurance rates:

-

How often are you in residence at your cottage?

-

Does your cottage stay open only seasonally or year-round?

-

Who uses your cottage (you, family, friends, rental tenants)?

-

Does someone check on your cottage regularly when you are not in residence?

-

What type of security system (if any) exists at your cottage?

-

Do you store any recreational vehicles at your cottage?

-

Do you store any personal valuables at your cottage when you are not in residence?

-

Is your cottage your primary or secondary residence?

-

Do you have other buildings (workshops, sheds, boathouses, garages) at your cottage?

-

Do you conduct any business at your cottage (renting it out or another enterprise)?

Your answers to these questions can impact what you pay as well as what types of coverage and riders you need to fully protect your cottage investment and your plans to use your cottage.

Are You a First-Time Seasonal Cottage Owner?

If you are entering cottage season as a proud cottage owner for the first time, congratulations! This is a dream for many Canadians, and you are about to begin living it!

We know there can be a huge learning curve in your first year of cottage ownership and cottage insurance is only one small part of that learning curve.

Our friendly, knowledgeable brokers are happy to walk you through the steps for how cottage insurance works, what coverage you need to protect your investment and how to adjust your policy seasonally to reflect your usage.

Get in Touch

Are you getting excited for the start of cottage season? We sure are! If you need help with a new cottage insurance policy or want to review your existing policy, we can help.

Contact us online or give us a call at 888-853-5552.

Click here to get an instant, online, no obligation cottage insurance quote now.

Modular Versus Manufactured Home: What Type of Home Insurance Do You Need?

Modular. Manufactured. Mobile. There are so many alternatives to the traditional brick-and-mortar home today! Figuring out the differences between each of them can be surprisingly tricky.

The challenge increases when you are trying to determine what type of home insurance policy you need to cover a manufactured home versus a mobile home versus a modular home.

In this post, we review each of these three popular home types and explain the differences between them. Then we talk about what type of insurance policy you need to cover the home you have or are considering purchasing.

3 Alternative Home Types: Modular, Manufactured, Mobile

Each of these three home types sounds quite similar at first glance. In fact, they do share some similarities.

Modular home

A modular home is a type of prefabricated home that is built first and then relocated to the home site.

This type of home is often created in two or more separate parts that are then joined together at the building site—hence the word “modular,” which means “parts.”

A modular home is typically situated on a concrete foundation that can accommodate a crawl space or a full basement.

For the most part, once a modular home is placed on a site, it cannot be moved and is treated just like a permanent home.

Manufactured home

A manufactured home is also a type of prefabricated home—that is, one that is built at a location other than the site at which it will be permanently placed.

But a manufactured home is typically built and transported in one piece rather than in separate modules. Here, the terms “double-wide” and “triple-wide” refer to the width of a manufactured home.

A manufactured home is constructed around a steel frame and sits atop concrete blocks or concrete or metal piers. A manufactured home can also be placed on a concrete slab as a permanent foundation. However, most manufactured homeowners prefer the former in case they want to move their home at a later date.

It is not uncommon for manufactured homes to have exterior additions such as stairs or ramps, porches or garages.

Mobile home

The term “mobile home” is sometimes used interchangeably with manufactured homes, RV or trailer. The former is what is meant in the context of home insurance.

A mobile home manufactured in Canada will have a CSA label. A mobile home manufactured in the USA will have a red HUD (Housing and Urban Development) label. These organizations govern manufacturing and safety standards for manufactured homes.

RV or Travel Trailer

Recreational vehicles are meant to be mobile. There are several different classes of RVs (A, B,C, etc.) describing different configurations of these vehicles.

What is important to remember here is that RVs and travel trailers are considered vehicles rather than homes. For this reason, you need a different type of insurance policy to cover an RV or travel trailer than what you need for a modular, manufactured or traditional mobile home.

Matching the Right Insurance to Your Home

The type of home insurance policy you need is related to two key factors: whether your home can be moved and the building code your home is built to conform to.

Modular home: standard homeowners insurance policy

Modular homes are typically constructed to comply with local or provincial building codes. For this reason, a modular home will usually be covered under the same type of homeowners insurance policy that a brick-and-mortar home requires.

Manufactured home: mobile/manufactured home insurance policy.

Manufactured homes, in contrast, are built to comply with federal CSA/HUD building codes. For this reason, they need to have a different type of homeowners insurance policy. This policy may be called a mobile home insurance policy or a manufactured home insurance policy.

Adjusting Your Coverages for Full Protection

Modern modular homes are often indistinguishable from traditional brick-and-mortar homes once set in place on their permanent site. Typically, homeowners insurance treats modular homes just like brick-and-mortar homes in terms of overall insurability.

The only adjustments you may need to make here will relate to personal coverage needs and preferences.

Manufactured houses are viewed a bit differently by potential insurers. Because the vast majority are not secured to a permanent foundation and retain wheels and a chassis to be moved at will, they are naturally less secure during inclement weather.

Weather events can potentially cause major damage or even total destruction to manufactured homes, which can raise annual premium rates for manufactured homeowners insurance. Similarly, since many manufactured homes carry less insulation than traditional or modular homes, pipes are more prone to freezing or exploding during extreme winter weather.

However, as a balancing factor, manufactured home structures also typically carry a lower overall valuation than permanent modular or brick-and-mortar homes. In other words, it generally costs less to repair or replace a manufactured home. This fact can help to offset the higher risk of damage or destruction.

There are also a number of optional safety features, such as hurricane straps or special skirting, that you can add on to help reduce the risk of storm or wind damage. These extra features can also help lower homeowners insurance premiums for manufactured homes.

Get in Touch

Do you own a mobile, modular or manufactured home or are you considering investing in one? Do you need expert guidance regarding the right type of homeowners insurance coverage? Our friendly, knowledgeable team of brokers can help!

Contact us online or give us a call at 888-853-5552.

Click here to get an instant, online, no obligation home insurance quote now.

8 Ways to Know You Need to Purchase Business Insurance

As of this year, there are an estimated 1.15 million small businesses scattered throughout Canada. Half of these are located in Ontario.

But if we fast-forward 10 years, statistics tell us nearly half of these businesses will have disappeared.

A variety of factors contribute to business survival, including number of employees, industry, economic fluctuations and leadership succession plans.

Often overlooked, however, is a business’s risk management strategy. This includes the strategic purchase of business insurance to protect the growing company from the inside out and the outside in.

In this post, we highlight eight key ways to know it is time to take out a business insurance policy for your small business.

Business Insurance Defined

The Government of Canada defines business insurance as “peace of mind.”

This definition may sound simplistic at first, but at its most fundamental level, this is precisely the role business insurance plays in safeguarding your company’s future.

There are many different types of business insurance to offer protection for various key aspects of your company. Business insurance can protect you and your employees, your materials and products, your company vehicles, your online activities and much more.

Different businesses need different types of business insurance. What type you acquire depends on the industry you work in, the size and scope of your operations, your net worth and even your local weather!

As a general rule of thumb, your business insurance policy should match your current needs, with a bit of room to grow.

8 Signs You Need Business Insurance

If you find yourself nodding while you read any of these 8 signs, please give one of our friendly and knowledgeable insurance brokers a call (contact information at the end of this post).

1. You set up a business website

Your business website is essentially your virtual workplace. This is especially the case if you have an online store (more about that in number 6 here), but even your blog and social media feed function as outgrowths of your business operations.

General business liability insurance will protect you in the event someone takes issue with content you post, images you use and advertising and marketing activities.

2. You hire someone to do work for you

Once you take on an employee, you open yourself up to a whole new level of risk. That employee may have an accident on the job or say or do something while working for you that harms someone or damages something.

For the former, workers’ compensation insurance provides protection for you and your employee. For the latter, professional liability insurance covers you for an employee’s (or your own) on-the-job errors that cause damage or harm.

3. You use your vehicle for your business

This is an area far too many business owners overlook to their personal peril.

What many small business owners don’t realize is that a personal auto insurance policy does not cover you if you have an auto accident while driving for work. Some insurers will even drop you if they discover you have filed a claim for a work-related incident under your personal auto policy.

For this, what you need is a commercial vehicle insurance policy. This way, you are protected when driving for work whether you use a personal vehicle or a business vehicle.

4. You carry raw materials or product inventory

Theft, vandalism and even natural disasters can wreak havoc with the raw materials or finished inventory you rely on to keep your business’s doors open. The same holds true for the basic equipment and supplies you use to do business, from your desk and office chair to your phones and computer equipment.

The type of business insurance you need to protect the premises can vary based on whether you are operating your business out of your home or out of a leased or owned commercial space. Commercial property insurance will protect the contents of that space, including raw materials, office supplies, equipment, furniture and finished goods.

5. You receive a new major order

Every business owner dreams of the day they receive their first large order that really solidifies their company’s place in their industry.

But in the glow of success, it is easy to forget this is also a time when you need to already have an active certificate of liability insurance in place to secure that new client.

6. You store confidential or personal customer data

If your website also functions as an online store, chances are good you are accepting and perhaps storing very sensitive customer data, including credit card or bank account information.

With the amount of online fraud activity today, it is smart to include a cyber insurance rider in your business insurance policy to protect you in the event of a data breach.

7. You have visitors to your business

Whether your company operates out of your basement or the office building down the street, you open yourself up to risk with each visitor that enters your space.

From trips and falls to property theft, you will want to have general liability business coverage in place to protect you if someone is injured or their property is damaged while they are visiting your business.

8. You act as an expert in your industry

Finally, in the litigious society we live and work in today, there is nothing to say someone won’t take issue with what you say or do, or your credentials to say or do it.

Errors and omissions insurance plus a professional liability insurance rider will protect you here.

Get in Touch

Contact us online or give us a call at 888-853-5552.

When Is the Right Time to Purchase a Life Insurance Policy?

Life insurance is that one product no one really wants to buy while they are living, but no one really wants to die without having it, either!

Even bringing up the topic of life insurance—when to buy it, how much of it to buy, how long to buy it for—can be a touchy subject between loved ones.

The truth is, life insurance isn’t easy to talk about! It gets even tougher once it is time to actually pick out a policy and iron out all the details of what, when, and how much.

In this post, we take a close look at the number one question most individuals, couples and families today have when it comes to life insurance: When is the right time to purchase a life insurance policy?

The Most Popular Time to Buy Life Insurance

Certain times in life can bring up the topic of life insurance more naturally.

Marriage

Getting married is one of those life-changing transitions that can prompt discussions about future financial planning.

For some couples, and especially those who want to start a family together, this can be a key moment to decide to take out a life insurance policy.

First baby

The hands-down most popular time people decide to purchase a life insurance policy is with the arrival of their first baby.

For most of us, this is the first time in our lives when we have a dependent who totally relies on us for everything they will need in life.

Taking out a life insurance policy can feel very reassuring in the sense that while you can’t control what may happen to you tomorrow, but you can control whether your baby will be provided for if the unthinkable occurs.

Retirement

Another popular time to think about taking out a life insurance policy is when you are approaching retirement age.

This is the time in life when most people’s minds turn to thoughts of aging, making a will, repaying any outstanding debts, making end-of-life arrangements and leaving something behind for loved ones.

The Best Time to Take Out a Life Insurance Policy

There is a big difference between the most popular time to purchase life insurance and the best time to purchase life insurance.

Investopedia points out that the best time to take out a life insurance policy is when you are born!

If you think about it, this strategy makes sense. You are as young as you will ever get, and presumably healthier than you will ever be again. You have no medical history to complicate approval or hike premium prices.

You have your whole life ahead of you to let your policy appreciate (which is especially important if you are buying life insurance as an investment).

Of course, you can’t purchase a life insurance policy for yourself when you are born, but it’s a very smart thing for a parent to do for a child.

There are two ways to take out life insurance on your child’s behalf. You can purchase a whole life insurance policy in your child’s name and then transfer policy ownership on their 18th birthday. Or you can pay a little bit more on your own term life insurance policy to add coverage for your child.

The Benefits of Purchasing Life Insurance

As the Government of Canada points out, life insurance is designed to provide some very specific benefits to loved ones in the event of your passing.

The life insurance payout is a tax-free lump sum payment. It can be used to pay for funeral and burial services, pay off debt, take care of dependents and loved ones or be put into an estate or trust. It can also be used to contribute to a charitable cause.

But the number one benefit that many people cite as their main motivation for purchasing a life insurance policy is simply peace of mind.

Types of Life Insurance Policies

As with any major purchase, your main reason for purchasing a life insurance policy will and should inform what type of policy you purchase.

There are two main types of policies: term and permanent. There is one basic difference between these two policy types: term life insurance expires and permanent does not.

Term

Term life insurance is the simplest type of policy. The main reason to purchase term life insurance is to have some type of protection in place for dependents or to repay debt if you pass during the term of the policy.

Permanent

Permanent life insurance offers two different subtypes: whole and universal.

Whole life insurance provides a guarantee that premium costs will not increase during the life of the policyholder along with a guaranteed death benefit payout.

Universal life insurance is the most flexible type of life insurance coverage. This policy type offers lots of options for how and when you pay your premiums, how you use accumulated earnings and the amount of the death benefit payout.

Making the Choice to Open a Life Insurance Policy

Even from this brief overview, you can see that making the choice to open a life insurance policy can get complicated quickly.

You have all kinds of choices and decisions, from when to open your policy to what type of policy to open to how long that policy will remain active.

Then you have decisions about how much coverage to take out, what to do with that coverage (especially if you have an investment-type policy) and who to name as your beneficiary.

The most important thing to remember here is that there is no one “right” time for everyone to take out a life insurance policy. There is only the time that is right for you.

Get in Touch

Contact us online or give us a call at 888-853-5552.

Why Insurance Is So Expensive in Ontario & What You Can Do About It

It’s no secret that Ontarians have some of the highest auto insurance rates nationwide.

This is a popular topic for major news outlets and certainly gets drivers’ attention when those annual premium notices go out.

“But why?” is the common refrain. Everyone is concerned about the cost of their insurance, from high-risk drivers to drivers with a spotless driving record.

Even officials representing the Insurance Bureau of Canada (IBC) acknowledge that Ontario’s auto insurance premiums are high and that the industry is struggling to get a handle on the situation.

What can you do to control your auto insurance costs when you live in the priciest province in the nation? We’ll show you: read on to find out!

Shop Around & Don’t Settle for “This Is the Best Rate You’re Going to Find”

Shopping around is a smart play. While the insurance industry as a whole uses some common factors such as age, gender, location, make/model, driving habits, driving record, etc.), individual insurers file their own rates. Different insurance companies reward different customers with a better price. As an example, Company A may have collected data that tells them that customers who park their car in their driveway have fewer claims than customers who park on the street. They may give a discount to those people. Company B may never have looked at that aspect of setting rates. If you are insured with Company B, you may be getting their best rate, but not the best rate available.

Similarly, because bottom-line price is such a powerful motivator for customers to switch insurers, insurers are free to offer their own incentives and discounts to retain customers and build loyalty. So if an insurance broker tells you that their offer is “the best you’re going to find,” keep looking. Chances are good they know their offer isn’t the best!

Buying your insurance from an insurance broker such as Mackay Insurance gives you an advantage over people who buy from a 1-800 number with only one option for them. Your broker can do some of that legwork for you and check which is the best insurance company for you.

Even if you are insured with a broker, periodically stop in and talk to them about your options. Your circumstances may have changed, and they may now have a better answer for you. A good time to touch base with your broker is when you get your annual renewal notice. And remember that no broker represents every insurance company there is. Periodically check the market yourself and satisfy yourself that you are not over-paying for your insurance.

Talk to Mackay Insurance for help with this. We represent many different insurance companies and can shop around and find the best deal for you. In addition, our knowledge and expertise can help find you discounts and rate reductions you may not have otherwise known about!

Carefully Review Your Insurance Discount & Savings Options With Your Broker Annually

Did you know that insurers will now discount your premiums if you install snow tires on your vehicle during the winter season? You may be able to save up to 5 percent for making this seasonal change! But you have to tell your broker or agent, or they won’t know to add the discount to your policy.

Some insurers will give you a discount if you choose to install a special app on your phone. This app is sort of like the black box on an airplane. It monitors your driving habits and can analyze this data to identify additional discounts you are eligible for (like not driving at night or regularly slamming on your brakes) to further lower your premium payments.

Another potential way to get discounts is to make your vehicle more difficult to steal! Anti-theft alarm systems and secure garaging may translate into lower risk to insure you and thus a premium discount.

Other Mainstream Ways to Lower Your Auto Insurance Premiums

While you might not love all of these savings options, each one does offer a potential avenue for lowering auto insurance premiums.

Consider a higher deductible

The deductible is the amount you pay personally if there is a claim, and the higher the deductible, the lower the premium. It generally is not advisable to put in very small claims anyway, and if your budget can handle paying a larger deductible if there was a larger claim you may as well save some premium and take a higher deductible.

One word of caution is to check what the actual savings are, as there is often something called a “diminishing return” on taking higher deductibles. For example, it may save you enough premium to be worth changing from a $500 to a $1,000 deductible, but you may find that the savings to bump the deductible from $1,000 to $2,500 don’t save you enough to make that next change. Every situation and every budget is unique, so talk to your broker about your own situation.

Drop your comprehensive and/or collision coverage

The Financial Services Commission of Ontario (FSCO) points out that an older, lower-value vehicle may not merit the additional, optional collision and/or comprehensive coverage you would want with a new vehicle.

Bundle your policies

When you purchase more than one type of insurance with the same broker, you may qualify for a discount of anywhere from 5 to 15 percent on your aggregate premiums.

Pay your premiums annually in one lump sum

It typically costs insurers less in administrative overhead to collect premiums in one annual lump sum than to send out and monitor monthly payment reminders. If this fits your budget you can save service charges.

In between paying monthly or paying for a full year is another option to investigate. Many insurance companies have an option to pay in two or three installments and do not charge the finance fee they would if you paid monthly.

Get in Touch

Are you shopping around for a lower rate on insurance? Our talented, seasoned brokerage team would love the opportunity to assist!

Contact us online or give us a call at 888-853-5552.

Use Our New Mobile App & Never Lose Track of Your Policy Information Again!

As our life today becomes increasingly hectic, it is easy to lose track of those old-fashioned paper insurance policy cards.

As our life today becomes increasingly hectic, it is easy to lose track of those old-fashioned paper insurance policy cards.

Also, moving, weather disasters, kids and pets can all too easily cause important printed policy information to simply “disappear.”

Here at Mackay Insurance, we are just as likely as you are to forget to place an updated insurance card in our vehicles or to replace last year’s now-outdated printed homeowner’s policy with the new updated document in our home filing system.

Some time ago, we realized that what we needed—and what our clients need—is a way to carry our insurance policy information with us at all times!

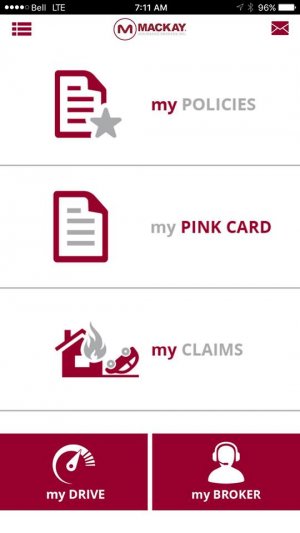

From that bright idea, the Mackay Insurance mobile app was born. From day one, we have worked hard to create an intuitive, fully functional mobile experience for iOS and Android devices where you can access all of your insurance policy information at all times and from one single portal.

In this post, meet the new Mackay Insurance mobile app and discover how it can make your life both easier and more organized!

Watch a Short Video Introducing Our Mobile App

In this short, focused introductory video, listen to our CEO, Bruce Mackay, review the new Mackay Insurance mobile app and its many features and benefits.

What Can Our Mobile App Help You Do?

The new Mackay Insurance mobile app is designed to keep you in touch and up to date. It provides this service in two ways:

The app keeps you in touch with your broker

There are times in life when you need to reach your insurance broker right away.

Whether you have questions about coverage, you need to initiate a claim, you are ready to add to or edit an existing policy or you have had a life change requiring a new type of coverage, with the new mobile app you can reach out to your Mackay Insurance broker via phone, email, chat or website.

The app keeps you in touch with your coverage and protection

With the new Mackay Insurance app installed on your phone, you can instantly access detailed information about each active insurance policy you carry.

You can also print new insurance liability cards, review coverage limits and details, begin filing a claim, request new coverage or different coverage, update your personal contact information and much more.

How to Download and Install Our New App

There are two easy ways to find, download and install the new Mackay Insurance mobile app.

-

You can do a search for it on the app store for your smartphone. Our app is supported for both iOS and Android devices.

-

You can visit our online client website and request your app login and password and a link to the new mobile app.

-

You can reach out via email (app@mackayinsurance.com) to request your login and password and a link to the new mobile app.

What You Can Do Using the New Mobile App

Once you have downloaded and installed the new Mackay Insurance mobile app, you have your entire insurance world at your fingertips!

As you launch the app, you will notice there is a separate page for each of your active insurance policies (auto, homeowners, life, business, etc.).

As you add a new policy, a page will automatically be created for that new policy. When you make changes to an existing policy, those changes will be reflected when you visit the app.

You can access and download or print out your policy information for all of your policies, including your official pink card, anytime you need them.

If you need to add a new policy, add another individual to an existing policy, change your personal information, file a claim, view your premiums and payments or reach your broker here at Mackay Insurance, all of these other features are also readily available each time you power up the new mobile app.

Winner: 2018 Favourite Insurance Broker for Belleville Intelligencer

A tidbit of breaking news: We are so proud to announce that Mackay Insurance has been named Favourite Insurance Broker by Belleville’s The Intelligencer Readers’ Choice Awards!

Mackay Insurance is a family-founded and -owned insurance brokerage. We have been serving the Quinte and surrounding areas for more than four decades, and we are so honoured to be recognized by our clients for our insurance services.

Do You Need a Quote for a New Insurance Policy?

Our online portal (and our new mobile app) make it easy to request a free quote for a new insurance policy.

Download and install our new Mackay Insurance mobile app or visit our online free quote estimate generator webpage to request a quote for auto insurance, property insurance, life insurance, motorcycle insurance, commercial insurance and collector car insurance.

Don’t see the insurance product you need on this list? Not to worry! Just reach out to us by phone, email or through our mobile app to request a quote for the insurance product you are seeking.

Get in Touch

Do you have questions about our new mobile app? Want to make a special request for new features you don’t see online yet? Do you need help locating or installing the Mackay Insurance app or navigating through all of its features?

Our friendly, professional, knowledgeable team is happy to help! Contact us online or give us a call at 1-888-853-5552 to set up a time for a phone or in-person introduction to our new mobile app!

Standard Vs. Storage Auto Insurance: Which Product Do You Need?

According to the Insurance Bureau of Canada, many recreational vehicle owners could be carrying the wrong type of auto insurance or not enough auto insurance.

Figuring out how to properly protect seasonal vehicles represents a common area of confusion for motorists, especially if you have one vehicle you drive year-round and other vehicles you drive only during a specific season.

If your seasonal vehicle isn’t carrying the right type of insurance, you may be putting your investment at great risk. In this article, learn the difference between storage insurance and standard auto insurance, how each product works and how to know which product you need!

What Is a Seasonal Vehicle?

The first information to sort out is the definition of a “seasonal vehicle.”

At its most basic, a seasonal vehicle is any vehicle that is not in use all year long. Common examples of seasonal vehicles include snowmobiles, recreational vehicles (RVs), classic cars, mopeds and motorcycles.

Most Ontarians put their seasonal vehicles into some type of secure storage during the off-season.

What Is Storage Vehicle Insurance?

Reducing insurance coverage while your vehicle is in storage may save you money.

When a seasonal vehicle is in use, you need full insurance coverage on it, including liability insurance. You also need to be sure the vehicle’s license plate sticker is current. These are legal requirements that protect you and others while you are operating that vehicle on or off the roadways.

However, when you put your seasonal vehicle into storage, you do not need coverage for road use. You may be able to remove liability insurance and collision coverage during the off-season and save money. Note that if your insurance coverage includes Comprehensive coverage (fire, theft, vandalism etc.) you should always keep this coverage on the vehicle while it is stored.

Some seasonal vehicle owners choose to let their insurance lapse or even cancel their policy for that vehicle during the off-season, but this is not advisable.

You don’t ever want to drop the comprehensive portion of your vehicle insurance policy, since this is your only protection against seasonal vehicle loss or damage due to fire, theft, natural disaster, vandalism and other non-collision threats.

When you are preparing to garage a seasonal vehicle for the off-season, you will need to call your broker to let them know you are ready to drop back to comprehensive-only insurance coverage.

Similarly, when you are preparing to take a seasonal vehicle out of storage for use again, you will need to make a note in your calendar to call your broker in advance to reactivate your standard vehicle insurance coverage.

When taking a vehicle out of storage, always be sure your license plate sticker on the car is current.

Note that there are circumstances when you will not simply be able to delete “driving coverage” from a seasonally used vehicle. You may need to pay the premium for full coverage and temporarily “suspend” the coverage you do not need. When full coverage is added back onto the vehicle, you will receive a credit/refund for the time the coverage was suspended.

What Is Included with Coverage Needed to Drive a Seasonal Vehicle?

When you are driving a seasonally used vehicle, the coverage you need is the same as for a vehicle used year round. There may or may not be coverage on the vehicle itself for collision, theft, etc. depending what you purchase. However, coverages that will always be included when a vehicle is insured to drive include:

Third-party liability coverage

Your third-party liability rider protects you if you cause harm or death to someone else or their property in an auto incident.

Statutory accident benefits coverage

Your statutory accident benefits protect you if you are injured in an auto incident regardless of who is at fault.

There are also a number of optional riders you can elect to purchase. You should review Accident Benefits options with your broker.

Direct compensation property damage (DC-PD) coverage

DC-PD provides you with compensation if your vehicle or its contents are damaged or lost due to the actions of another driver (if certain other conditions are also met).

Uninsured automobile coverage

Uninsured automobile coverage protects you against hit-and-run drivers and uninsured motorists.

Specialty Vehicle Vs. Seasonal Vehicle

Certain types of vehicles, such as motorcycles and snowmobiles, are seasonal by their nature. For these vehicles, the full premium is earned during the season they are typically used.

For example, traditional motorcycle insurance is designed to cover the policyholder year-round but is automatically prorated to account for storing the bike in the winter. It is not necessary to change the coverage seasonally, and there are no premium savings if you do.

Get in Touch

Here at Mackay Insurance, our knowledgeable, experienced team of brokers has more than 165 combined years of cross-disciplinary insurance industry expertise. We can get you the most insurance for the most competitive pricing with all the available discounts.

If you prefer, you can also use our easy online quote generator tool to receive a free insurance quote on the product of your choice within minutes.

Do you need individual guidance on how to ensure your vehicles are properly insured for year-round and seasonal use? Contact us online or give us a call at 1-888-853-5552 for fast, personalized service

Click here for a free, instant, online, no obligation auto insurance quote.

Contractor Insurance: If You Donít Have It, You Need It. Hereís Why!

If you own a home or a car, chances are good you have purchased some type of insurance policy to protect you from loss, theft or damage.

So it just makes good sense that you would want to put the same protection in place for your business! While the self-employment sector of the Canadian workforce continues to grow larger each year, this type of smaller business is also more vulnerable to setbacks ranging from theft or vandalism to natural disaster, lawsuits and personal setbacks.

Contractor insurance is a type of insurance product specifically designed and uniquely well-equipped to help your business handle the inevitable ups and downs of working as an independent contractor. In this post, learn what you need to know about contractor insurance, including how much you need and how to apply.

Mandatory Insurance Coverage for Contractors

Here in Ontario, you are required to register your independent construction company with the Workplace Safety and Insurance Board (WSIB) and retain certain mandatory insurance coverages.

This mandate extends to contracting businesses from very small to very large.

Not surprisingly, wading through the complex assortment of laws and regulations regarding contractor insurance can be a full-time job. After you get done sorting out which insurance policies you need, what they cover and what is still missing, then it is time to tackle tax accounting requirements, mandatory worker training, licenses, certificates and day-to-day business management.

This explains why so many independent contractors often feel like they are working themselves to death and still not getting ahead!

We want to make contractor insurance easy to understand and acquire so you can get back to your real job—managing and growing your business.

What Type of Contractor Insurance Do You Need?

Regardless of how small or large your company size is, you will need the same basic types of insurance protection.

Completed operations

Completed operations insurance protects contractors from client lawsuits that may occur months or years after the job is completed.

Customer disputes

Even a single dispute that evolves into a lawsuit can topple a small independent contracting business. Customer disputes can occur despite your best efforts, which is why you need insurance coverage to protect your business itself while the lawsuit progresses.

Equipment

As an independent contractor, you have invested heavily into the success of your company, right down to purchasing and maintaining the equipment and materials you use to do your job. If your equipment breaks down or gets damaged on the job site or en route, this is the coverage you need.

Business interruption

Business interruption can occur for many reasons. This insurance coverage protects your company if your income stream is halted due to insured events beyond your control.

Liability

This general term covers many exposures contractors face, ranging from injuries resulting from work that was performed to simple trips and falls on the job site. This type of contractor insurance is an ironclad necessity in today’s litigious society.

Business property

You need to protect your own business property just as you would your personal residence or vehicle. Materials, equipment, supplies and other assets housed at your business location or job site can be protected under a business property insurance policy.

Crime

Crime is another hazard of doing business today, and an increasingly serious one, at that. From workers with sticky fingers to strangers who see your job site-in-progress as an easy score, you can’t always control who comes by or what damage they may do. But you can control how much it impacts your growing business by adding a crime insurance rider to your contractor insurance policy.

How a Contractor Insurance Policy Can Benefit You

The obvious benefits of a contractor insurance policy are clear at this point: you don’t risk losing your business in the event other people or events intersect in a way that limits or interrupts the work you are doing.

But there are other, less-visible benefits of taking out a contractor insurance policy.

Customer trust

A major benefit is customer trust. When a new client contacts you to bid on a job, having contractor insurance in place can give them valuable peace of mind and increase the likelihood that you will get the job.

Peace of mind

Another major benefit is your own peace of mind. It’s hard to run a successful business from a place of fear, worry and stress! When you know that your best efforts are protected from unknowns such as climate change-related weather patterns and the actions of criminals, you can conduct operations with more confidence and courage.

Freedom to collaborate

Still another benefit that comes along with adding contractor insurance to your risk management program is the ability and freedom to collaborate on construction jobs knowing you are protected if something goes wrong.

As the Canadian Design-Build Institute explains, expert collaboration is a mainstay in an industry where technology is producing sweeping changes to how jobs are planned and executed. But without insurance protection, the blurred lines of responsibility that collaboration sometimes creates can become harder to navigate in jobs gone wrong.

Worker and personal protection

Finally, having a customized contractor insurance policy in place provides protection to those whose livelihoods depend on yours: your workers, vendors, staff and family.

Get in Touch

Here at Mackay Insurance Brokers, we have more than 165 combined years of personal, residential, auto and commercial insurance expertise. Our seasoned staff bring a customer-service-first focus to every consultation and every policy we write.

Chat with us online, email us or give us a call at 1-888-853-5552 to speak with a knowledgeable agent today.

Insurance Basics: How to Figure Out How Much Insurance You Need

The world of insurance can be a complicated one even from the inside out. From the outside in, it can sometimes feel nearly impossible to work out exactly what type of insurance you need.

Here at Mackay Insurance, we have been serving our continually growing list of clients for more than four decades. Even so, there is still something new to learn about the insurance industry each and every day!

One of the most frequently asked questions we hear every day is, “How do I figure out how much insurance I need?” That is what we are going to talk about in this article.

Types of Insurance

You may find you need different types of insurance at different times in your life.

There are four basic types of insurance policies:

Of course, there can be many subsidiary types of insurance policies within each of these major insurance categories.

For example, homeowner insurance can also include renter insurance, cottage or seasonal home insurance, flood insurance and other related policies. Auto insurance also encompasses motorcycle insurance, recreational vehicle insurance, classic or vintage car insurance, RV and motorhome insurance.

Life insurance is its own separate arena with a variety of policies ranging from a simple term life insurance policy to complex whole life (permanent) life insurance.

Business insurance can span the gamut from commercial vehicle insurance to liability insurance to a specialized suite of insurance products geared toward large corporations, home-based businesses and nonprofit entities.

There are also various specialty insurance policies, such as travel insurance, high value/rare possessions insurance, health insurance, long-term disability insurance and pet insurance.

Insurance Basics You Should Know

Even if you don’t know much about insurance itself, you probably recognize the word “premium.” This is the fee you pay in order to receive insurance coverage.

Premium costs

Your premium can vary quite a lot based on a wide variety of factors. Some factors will be beyond your control. For example, the make and model of the car you drive, the neighborhood you live in, even your personal health history can influence how much you pay for insurance coverage.

But some factors will be within your control. For instance, you can bundle a variety of policy types together with a single insurance provider to receive a discount on your total policy premiums.

Deductible levels

You can also set your deductible level higher or lower to influence how much you pay in insurance premiums annually. Some insurance companies offer payment options that avoid finance fees—for example, making three payments instead of paying monthly.

A higher deductible will lower the premium, but you want to check pricing before simply going with a high deductible. If the premium savings for switching to a higher deductible is modest, you may prefer a lower deductible. An important question when choosing a deductible is what amount you could come up with comfortably if you had a claim. If the most you could come up with is $1,000, then a $2,500 deductible may not be a good solution for you even if the cost is lower.

Optional discounts

In addition to a discount for bundling multiple types of policies together under a single insurance provider, there are often other discounts you may qualify to receive. Examples include discounts for installing winter-rated tires during the winter months, security features of your car or home and being mortgage-free on your home. Even if you are not shopping to change insurance companies, periodically stop in to see your broker and talk through you circumstances and what discounts you may be eligible for.

Choosing Your Insurance Provider

Here in Canada, car insurance is regulated by each province or territory. For the most part, the coverage from different insurance companies operating in the same province will be the same. However, prices can vary significantly—different insurance companies specialize in different segments. It is worth checking options, and a broker who represents several insurance companies can do the shopping for you.

Other types of insurance, such as house insurance, are less regulated. There will often be core coverages that are the same between companies, and there can then be significant differences in the coverage that one company provides compared to another. As an example, Company A may offer flood insurance at your address, and Company B may not.

Customer service

You want to be sure the broker or insurer you select can communicate with you the way you like to communicate. In-person visits? Telephones answered by a live person? Email? Chat-based live customer service support? All options are available, but not always all from the same broker or insurance company.

Claims processing

Research what other customers say about working with this insurer and whether the insurer serves as a client advocate when claims are filed.

Get in Touch

Contact us online, or give us a call at 1-888-852-5552 for help with all your insurance needs!

7 Tips to Keep Your Canadian Insurance Affordable

Insurance is our business, so of course we are passionate about what we do!

But honestly, in the four-plus decades our doors have been open, we have yet to meet a new client who is truly excited about buying insurance.

Insurance generally falls into the “must-have” category rather than in the “want to have” category. You know you need it and you understand the risk of not having it, so you put a line item in your annual budget and you renew your policies when their renewal dates arrive.

But if purchasing insurance itself isn’t particularly fun or exciting, imagine what it feels like to learn you have been paying more for your insurance than you need to! That is the real bummer in our industry, and one we want to help our clients avoid!

In this post, learn seven key tips to make sure you are paying a fair price for your insurance.

1. Check Your Credit and Ask Your Insurer to Do the Same

In today’s global online marketplace, where many industries now service a provincewide or even nationwide clientele, credit scores are more important than ever as a screening factor.

Your credit history and score can say a lot about how you handle money and debt. When you’ve worked hard to keep your credit score high or you have worked hard to repair your credit after a tough situation, you deserve the benefits that now affords you!

One benefit can be a lower property insurance premium. You can even pull your own credit score first, review it and clear away any issues. When it is squeaky clean, ask your insurer about credit rating and insurance—you may just earn yourself a discount!

2. Bundle Your Insurance Products

The insurance industry is heavily regulated by provincial and national laws, but oddly, this just makes the competition stiffer to win and keep new clients.

We attract and retain customers through excellent customer service. This includes looking for discounts for our customers. A perk many insurers offer is premium discounts when a customer takes out more than one policy. For example, maybe you have a home insurance policy with us, and now you want to take out an auto insurance policy as well. Or perhaps you have your auto insurance policy with us and your spouse is insured somewhere else. Let us take a look at bundling everything for you. The discounts can be substantial when you bundle more than one insurance policy together with a single insurer.

3. Find the Cheapest Way to Pay

Another easy way to cut insurance premium costs is to opt for the cheapest payment plan the insurer offers. This all relates to the insurer’s own costs of processing payments. You can pay for the year up front, or with many insurers, a three-payment option does not carry any service charge at all.

If one of these payment methods aligns with your budget it can net you a discount of 3 percent or more, without lifting a finger!

4. Review Your Coverage Annually

Your life does not stand still. You add a deck to your house. Babies are born. Kids leave for university. You swap out that old oil furnace for a new propane furnace. Your income changes. You decide to close in your swimming pool. An aging parent has moved into that basement bedroom that your university-aged son or daughter vacated. The policies that fit you perfectly five years ago may not fit who you are today. You may have new exposures that need to be looked at, or you may be paying to insure things you no longer need to insure.

You should make a point to review your insurance policies when they renew each year, and phone or stop in every few years to go through them in person with a broker. Tailoring your insurance to your current needs can sometimes deliver a surprising number of savings!

5. Increase Your Deductible

Even if you aren’t able to find any areas where you are over-insured, there may be options to raise your deductible (the amount you pay out of pocket if you make a claim) and realize cost savings.

The one caveat here is that you should not raise your deductible above the amount you can comfortably afford to pay if you do have a claim under that policy.

6. Don’t Call In That Claim

In the same way that you have to do a bit of forecasting to figure out how much insurance coverage to take out each year, so too does your insurer have to forecast to figure out how to keep the insurance business affordable for clients yet still profitable for the company.

Many insurers now offer a “claims-free” incentive or discount for clients who have not filed any claims for a specific period of time. Sometimes this incentive increases with the amount of time the client has been claims-free.

Not only is it quite likely that your next year’s insurance premium will go up if you file a claim (since this makes you more expensive to insure), but also you will forfeit any claims-free incentive your insurer is offering.

This is not to discourage you from filing claims, necessarily, but simply to say that if your claim is for something small or something your deductible barely covers, it may be worth your while to just pay that particular expense out of pocket to keep your premiums lower.

7. Adjust Your Coverage As Your Property Ages

Your auto is one of the biggest-ticket items you will ever own. But as a car ages, the cost of maintaining full insurance coverage may outweigh your actual benefits.

This can be worth exploring if you are insuring an older vehicle.

Get in Touch

Have questions or want to review your insurance coverage before you renew? Contact us online, or give us a call at 888-853-5552!

How to Select Tenant Insurance You Can Trust

Many renters don’t think about tenant insurance unless their landlord requires proof of a policy as a condition for renting.

It is all too easy to look at renting as a “no responsibility” situation—you pay for the space you live in and your landlord takes care of the heavy lifting for things like repairs and insurance. Many renters in Canada don’t carry tenant (renter's) insurance!

This strategy can backfire. As a renter, you are exposed to serious liability issues, both in your home and away. The easy and affordable solution is to buy a tenant insurance policy.

In this post, we take a close look at the benefits of tenant insurance so you can decide if now is the right time to take out a policy.

What Is Tenant Insurance?

You can bet that your landlord carries an insurance policy that protects the premises and structure of the building itself. However, for all intents and purposes, your landlord’s policy ends at your front door.

What lies inside your space—your possessions—is not covered by your landlord’s insurance policy.

This means that tenant insurance is the policy you need in order to protect personal items you have spent your hard-earned money to purchase.

The Star reports that tenant insurance often costs less than $1 per day and calls taking out a renter insurance policy a “no-brainer.”

But is it, really? Let’s take a look at exactly what a typical tenant insurance policy covers.

What Does Tenant Insurance Cover?

The typical basic tenant insurance policy covers two key things:

1. Personal property

Your personal belongings will be covered up to a certain dollar amount. You will select the amount of insurance needed to replace your possessions. You can add policy riders if you have high-valued jewelry, cameras or other special property and collections.

Many young renters in particular take the position that their personal possessions are not valuable enough to take out a renter policy. It is important to test out that theory by making a list of your valuables, assigning a dollar value to each. Though you have used your furniture and clothing and perhaps could not sell it for much, most tenant policies insure property for the cost to replace the item with new property—new for old.

For example, you might be readily able to replace your laptop or your watch if one of these items was stolen. But would you be financially able to replace all of your valuables at the same time if your home was broken into and robbed?

As well, if you choose to take your personal property outside your home and put it in the car and your car is broken into, your tenant insurance policy will still cover the loss. The same holds true if a valuable item is stolen or damaged on a trip or while you are running errands.

2. Personal liability

Personal liability is often an area of confusion for many. What does “personal liability” mean? You can be held liable (legally and financially responsible) for actions you take that cause harm to other people or damage to their property.

For example, let’s say you light a candle and fall asleep. Meanwhile, the air conditioning comes on and blows the curtains into the candle flame and they catch fire. By the time you wake up, the fire is spreading from your apartment to nearby units.

Without a renter insurance policy to protect you, you could be held liable for the damage your actions caused to your landlord’s building and other tenants!

Personal liability also covers you in case someone visits you, trips and falls, and decides to sue you. If you are away from home and cause injury to someone else that is not auto-related, your personal liability coverage can also protect you.

Tenant Insurance: Replacement Value Versus Actual Cash Value

You can choose whether to purchase a tenant insurance policy that covers the full replacement value of your personal items or the actual cash value at the time your items were stolen, lost or destroyed.

Opting for a policy that covers the full replacement value ensures you won’t have to dip into your own pocket to account for depreciation or changes in market price.

Tenant Insurance: All Risk Versus Named Perils

There are two types of renter insurance policies: all risk and named perils. Under an all risk policy, only perils that are specifically excluded in the policy fine print will not be covered.

Under a named perils policy, only perils that are listed in the policy are covered.

Perils, as the name suggests, is a term that means bad things that could happen. For example, a flood is a peril. So is a fire. Theft, vandalism, wind damage, water damage, rain or hail damage, even getting struck by lightning, are all considered perils.

Tenant insurance typically covers these types of perils so that if your personal items are lost due to any of these occurrences, you will have coverage to replace them.

Additional Living Expenses Coverage

Tenant insurance also covers your expenses if an insured event beyond your control causes your rental home to become uninhabitable and you need to live elsewhere until repairs can be made. For example, let’s say there was a fire and now your landlord needs several months to make repairs before you can move back in.

Where will you stay? How will you eat? These costs can really add up, especially if you don’t have a friend or family member who can afford to put you up at no cost while you are waiting to move back into your unit.

Get a Free Tenant Insurance Quote!

It is free and easy to generate a quote for tenant insurance. Just visit our quick quote generator tool to get started.

If you have questions or want to speak with an agent personally, give us a call at 1-888-853-5552!

Do You Run a Home-Based Business? Why You Need Business Insurance

It is exciting to get a new home-based business up and running! For many Canadians today, being able to work from home profitably is a huge “bucket list” goal.

The number of home-based businesses throughout Canada grows each year, which is great news for Canada’s economy.

However, a surprising number of home-based business owners do not realize that their home insurance coverage may not provide coverage for claims associated with their home business operations.

This can put both the business owner and the business at risk of exposure to liability and legal issues. In this article, we talk about why we recommend home-based business insurance.

What is Home-Based Business Insurance?

As the name implies, home-based business insurance is an insurance policy that is specifically tailored to the unique needs and potential liability issues of a business that is operated out of your residence.

What Are the Types of Home-Based Business Insurance?

There are two basic types of home-based business insurance. It is important to talk to your broker about your business and determine which of these solutions is right for you.

Extension of an existing homeowners policy

The first type of home-based business insurance can be provided through an extension of your existing home insurance policy.

This type of insurance may fit your needs if your business has just one or two employees without a lot of foot traffic through the home (customers, vendors, employees).

Standard business insurance policy

If you have a larger or more high-value business, or you are storing business inventory at your home, you may need a standard business insurance policy instead.

What Does a Home-Based Business Insurance Policy Cover?

Both types of home-based business insurance policies offer certain standard features that all business owners should have in place.

Property

For general purposes, the majority of home-based businesses have several types of business-related property kept on the premises to help run the business.

Examples include home office equipment (desks, file cabinets, printers, scanners, computers), business inventory (raw materials, finished products, packaging, marketing materials) and cash reserves.

Your property coverage typically provides coverage for business property losses in your home and any items you may transport for business purposes that are lost, stolen, vandalized or destroyed while you travel.

Your cash on hand needs to be looked at separately. You will need the correct amount of insurance, and insurance against the correct perils. As an example there is different coverage needed to protect you if someone breaks in and steals your cash (theft), if someone holds you up at gunpoint on the way to the bank (burglary), and if an employee steals from you.

Liability

Business liability coverage will protect you if, for example, a customer is injured while at your home. It can also protect you from legal issues that arise from damage that can be traced back to your company’s services or products.

Business interruption

Business interruption insurance is a valuable resource for small and home-based businesses in particular, since often even a short interruption may greatly impact the viability and health of the business.

Business interruption insurance can compensate you for being unable to run your business due to your place of business (in your case, your home) being unusable due to a fire or other insured peril. It may also cover the costs for you to move your business operations to another location until you can move back into your home.

Extra Business Insurance Coverage You May Need

The specific type and level of home-based business insurance coverage you need can vary depending on the type of business you operate as well as on the scope of the business and the number of employees you have.

For example, let’s say you run a service-based business. Your main “product” is your expertise. If you give professional advice, you may need a professional liability (errors and omissions) policy.

This policy covers and protects you if a client sues you for professional negligence or malpractice.

Businesses that work with children or at-risk adults face a higher liability exposure. In addition to slips, falls, accidents and other bodily injury issues, you need insurance that will pay for your defence costs if abuse is alleged.

You may need special insurance if your business property includes antiques, rare items, high-value items or unique items.

It is important to talk through your home-based business with your broker and put together the right coverage to meet your needs.

How to Determine What Business Coverage You Need

A technical term for figuring out what to insure and for how much is “risk management.”

Risk management means identifying possible risks in advance and then working backward to put a plan in place to both prevent them from occurring and protect you if they do occur.

You can use risk management to figure out how much insurance coverage your home-based business needs by following these four steps:

-

Ask yourself what could go wrong. Write down everything you can think of.

-

Brainstorm ideas for how to prevent each risk from ever happening.

-

Assign a dollar value (or range) to each risk—how will it impact your bottom line?

-

Brainstorm ideas for how your business will recover if each risk happens.

Doing this pre-work can come in handy when you meet with your insurance broker. You will already have a good idea of the potential impact of each business risk, and your broker can help tailor your insurance policies to meet your needs.

Get in Touch

Here at Mackay Insurance, we have a combined 165+ years of insurance industry expertise! Contact us online or give us a call at 888-853-5552 to find out how we can help you protect your home-based business!