Mackay Insurance Blog

General

Why Insurance Is So Expensive in Ontario & What You Can Do About It

It’s no secret that Ontarians have some of the highest auto insurance rates nationwide.

This is a popular topic for major news outlets and certainly gets drivers’ attention when those annual premium notices go out.

“But why?” is the common refrain. Everyone is concerned about the cost of their insurance, from high-risk drivers to drivers with a spotless driving record.

Even officials representing the Insurance Bureau of Canada (IBC) acknowledge that Ontario’s auto insurance premiums are high and that the industry is struggling to get a handle on the situation.

What can you do to control your auto insurance costs when you live in the priciest province in the nation? We’ll show you: read on to find out!

Shop Around & Don’t Settle for “This Is the Best Rate You’re Going to Find”

Shopping around is a smart play. While the insurance industry as a whole uses some common factors such as age, gender, location, make/model, driving habits, driving record, etc.), individual insurers file their own rates. Different insurance companies reward different customers with a better price. As an example, Company A may have collected data that tells them that customers who park their car in their driveway have fewer claims than customers who park on the street. They may give a discount to those people. Company B may never have looked at that aspect of setting rates. If you are insured with Company B, you may be getting their best rate, but not the best rate available.

Similarly, because bottom-line price is such a powerful motivator for customers to switch insurers, insurers are free to offer their own incentives and discounts to retain customers and build loyalty. So if an insurance broker tells you that their offer is “the best you’re going to find,” keep looking. Chances are good they know their offer isn’t the best!

Buying your insurance from an insurance broker such as Mackay Insurance gives you an advantage over people who buy from a 1-800 number with only one option for them. Your broker can do some of that legwork for you and check which is the best insurance company for you.

Even if you are insured with a broker, periodically stop in and talk to them about your options. Your circumstances may have changed, and they may now have a better answer for you. A good time to touch base with your broker is when you get your annual renewal notice. And remember that no broker represents every insurance company there is. Periodically check the market yourself and satisfy yourself that you are not over-paying for your insurance.

Talk to Mackay Insurance for help with this. We represent many different insurance companies and can shop around and find the best deal for you. In addition, our knowledge and expertise can help find you discounts and rate reductions you may not have otherwise known about!

Carefully Review Your Insurance Discount & Savings Options With Your Broker Annually

Did you know that insurers will now discount your premiums if you install snow tires on your vehicle during the winter season? You may be able to save up to 5 percent for making this seasonal change! But you have to tell your broker or agent, or they won’t know to add the discount to your policy.

Some insurers will give you a discount if you choose to install a special app on your phone. This app is sort of like the black box on an airplane. It monitors your driving habits and can analyze this data to identify additional discounts you are eligible for (like not driving at night or regularly slamming on your brakes) to further lower your premium payments.

Another potential way to get discounts is to make your vehicle more difficult to steal! Anti-theft alarm systems and secure garaging may translate into lower risk to insure you and thus a premium discount.

Other Mainstream Ways to Lower Your Auto Insurance Premiums

While you might not love all of these savings options, each one does offer a potential avenue for lowering auto insurance premiums.

Consider a higher deductible

The deductible is the amount you pay personally if there is a claim, and the higher the deductible, the lower the premium. It generally is not advisable to put in very small claims anyway, and if your budget can handle paying a larger deductible if there was a larger claim you may as well save some premium and take a higher deductible.

One word of caution is to check what the actual savings are, as there is often something called a “diminishing return” on taking higher deductibles. For example, it may save you enough premium to be worth changing from a $500 to a $1,000 deductible, but you may find that the savings to bump the deductible from $1,000 to $2,500 don’t save you enough to make that next change. Every situation and every budget is unique, so talk to your broker about your own situation.

Drop your comprehensive and/or collision coverage

The Financial Services Commission of Ontario (FSCO) points out that an older, lower-value vehicle may not merit the additional, optional collision and/or comprehensive coverage you would want with a new vehicle.

Bundle your policies

When you purchase more than one type of insurance with the same broker, you may qualify for a discount of anywhere from 5 to 15 percent on your aggregate premiums.

Pay your premiums annually in one lump sum

It typically costs insurers less in administrative overhead to collect premiums in one annual lump sum than to send out and monitor monthly payment reminders. If this fits your budget you can save service charges.

In between paying monthly or paying for a full year is another option to investigate. Many insurance companies have an option to pay in two or three installments and do not charge the finance fee they would if you paid monthly.

Get in Touch

Are you shopping around for a lower rate on insurance? Our talented, seasoned brokerage team would love the opportunity to assist!

Contact us online or give us a call at 888-853-5552.

Use Our New Mobile App & Never Lose Track of Your Policy Information Again!

As our life today becomes increasingly hectic, it is easy to lose track of those old-fashioned paper insurance policy cards.

As our life today becomes increasingly hectic, it is easy to lose track of those old-fashioned paper insurance policy cards.

Also, moving, weather disasters, kids and pets can all too easily cause important printed policy information to simply “disappear.”

Here at Mackay Insurance, we are just as likely as you are to forget to place an updated insurance card in our vehicles or to replace last year’s now-outdated printed homeowner’s policy with the new updated document in our home filing system.

Some time ago, we realized that what we needed—and what our clients need—is a way to carry our insurance policy information with us at all times!

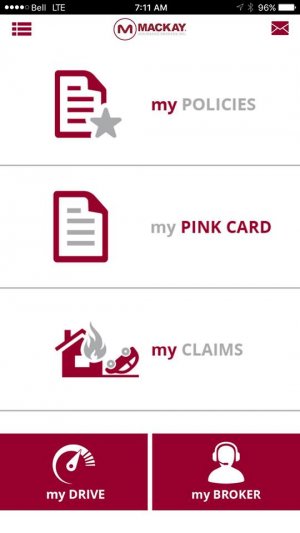

From that bright idea, the Mackay Insurance mobile app was born. From day one, we have worked hard to create an intuitive, fully functional mobile experience for iOS and Android devices where you can access all of your insurance policy information at all times and from one single portal.

In this post, meet the new Mackay Insurance mobile app and discover how it can make your life both easier and more organized!

Watch a Short Video Introducing Our Mobile App

In this short, focused introductory video, listen to our CEO, Bruce Mackay, review the new Mackay Insurance mobile app and its many features and benefits.

What Can Our Mobile App Help You Do?

The new Mackay Insurance mobile app is designed to keep you in touch and up to date. It provides this service in two ways:

The app keeps you in touch with your broker

There are times in life when you need to reach your insurance broker right away.

Whether you have questions about coverage, you need to initiate a claim, you are ready to add to or edit an existing policy or you have had a life change requiring a new type of coverage, with the new mobile app you can reach out to your Mackay Insurance broker via phone, email, chat or website.

The app keeps you in touch with your coverage and protection

With the new Mackay Insurance app installed on your phone, you can instantly access detailed information about each active insurance policy you carry.

You can also print new insurance liability cards, review coverage limits and details, begin filing a claim, request new coverage or different coverage, update your personal contact information and much more.

How to Download and Install Our New App

There are two easy ways to find, download and install the new Mackay Insurance mobile app.

-

You can do a search for it on the app store for your smartphone. Our app is supported for both iOS and Android devices.

-

You can visit our online client website and request your app login and password and a link to the new mobile app.

-

You can reach out via email (app@mackayinsurance.com) to request your login and password and a link to the new mobile app.

What You Can Do Using the New Mobile App

Once you have downloaded and installed the new Mackay Insurance mobile app, you have your entire insurance world at your fingertips!

As you launch the app, you will notice there is a separate page for each of your active insurance policies (auto, homeowners, life, business, etc.).

As you add a new policy, a page will automatically be created for that new policy. When you make changes to an existing policy, those changes will be reflected when you visit the app.

You can access and download or print out your policy information for all of your policies, including your official pink card, anytime you need them.

If you need to add a new policy, add another individual to an existing policy, change your personal information, file a claim, view your premiums and payments or reach your broker here at Mackay Insurance, all of these other features are also readily available each time you power up the new mobile app.

Winner: 2018 Favourite Insurance Broker for Belleville Intelligencer

A tidbit of breaking news: We are so proud to announce that Mackay Insurance has been named Favourite Insurance Broker by Belleville’s The Intelligencer Readers’ Choice Awards!

Mackay Insurance is a family-founded and -owned insurance brokerage. We have been serving the Quinte and surrounding areas for more than four decades, and we are so honoured to be recognized by our clients for our insurance services.

Do You Need a Quote for a New Insurance Policy?

Our online portal (and our new mobile app) make it easy to request a free quote for a new insurance policy.

Download and install our new Mackay Insurance mobile app or visit our online free quote estimate generator webpage to request a quote for auto insurance, property insurance, life insurance, motorcycle insurance, commercial insurance and collector car insurance.

Don’t see the insurance product you need on this list? Not to worry! Just reach out to us by phone, email or through our mobile app to request a quote for the insurance product you are seeking.

Get in Touch

Do you have questions about our new mobile app? Want to make a special request for new features you don’t see online yet? Do you need help locating or installing the Mackay Insurance app or navigating through all of its features?

Our friendly, professional, knowledgeable team is happy to help! Contact us online or give us a call at 1-888-853-5552 to set up a time for a phone or in-person introduction to our new mobile app!

Insurance Basics: How to Figure Out How Much Insurance You Need

The world of insurance can be a complicated one even from the inside out. From the outside in, it can sometimes feel nearly impossible to work out exactly what type of insurance you need.

Here at Mackay Insurance, we have been serving our continually growing list of clients for more than four decades. Even so, there is still something new to learn about the insurance industry each and every day!

One of the most frequently asked questions we hear every day is, “How do I figure out how much insurance I need?” That is what we are going to talk about in this article.

Types of Insurance

You may find you need different types of insurance at different times in your life.

There are four basic types of insurance policies:

Of course, there can be many subsidiary types of insurance policies within each of these major insurance categories.

For example, homeowner insurance can also include renter insurance, cottage or seasonal home insurance, flood insurance and other related policies. Auto insurance also encompasses motorcycle insurance, recreational vehicle insurance, classic or vintage car insurance, RV and motorhome insurance.

Life insurance is its own separate arena with a variety of policies ranging from a simple term life insurance policy to complex whole life (permanent) life insurance.

Business insurance can span the gamut from commercial vehicle insurance to liability insurance to a specialized suite of insurance products geared toward large corporations, home-based businesses and nonprofit entities.

There are also various specialty insurance policies, such as travel insurance, high value/rare possessions insurance, health insurance, long-term disability insurance and pet insurance.

Insurance Basics You Should Know

Even if you don’t know much about insurance itself, you probably recognize the word “premium.” This is the fee you pay in order to receive insurance coverage.

Premium costs

Your premium can vary quite a lot based on a wide variety of factors. Some factors will be beyond your control. For example, the make and model of the car you drive, the neighborhood you live in, even your personal health history can influence how much you pay for insurance coverage.

But some factors will be within your control. For instance, you can bundle a variety of policy types together with a single insurance provider to receive a discount on your total policy premiums.

Deductible levels

You can also set your deductible level higher or lower to influence how much you pay in insurance premiums annually. Some insurance companies offer payment options that avoid finance fees—for example, making three payments instead of paying monthly.

A higher deductible will lower the premium, but you want to check pricing before simply going with a high deductible. If the premium savings for switching to a higher deductible is modest, you may prefer a lower deductible. An important question when choosing a deductible is what amount you could come up with comfortably if you had a claim. If the most you could come up with is $1,000, then a $2,500 deductible may not be a good solution for you even if the cost is lower.

Optional discounts

In addition to a discount for bundling multiple types of policies together under a single insurance provider, there are often other discounts you may qualify to receive. Examples include discounts for installing winter-rated tires during the winter months, security features of your car or home and being mortgage-free on your home. Even if you are not shopping to change insurance companies, periodically stop in to see your broker and talk through you circumstances and what discounts you may be eligible for.

Choosing Your Insurance Provider

Here in Canada, car insurance is regulated by each province or territory. For the most part, the coverage from different insurance companies operating in the same province will be the same. However, prices can vary significantly—different insurance companies specialize in different segments. It is worth checking options, and a broker who represents several insurance companies can do the shopping for you.

Other types of insurance, such as house insurance, are less regulated. There will often be core coverages that are the same between companies, and there can then be significant differences in the coverage that one company provides compared to another. As an example, Company A may offer flood insurance at your address, and Company B may not.

Customer service

You want to be sure the broker or insurer you select can communicate with you the way you like to communicate. In-person visits? Telephones answered by a live person? Email? Chat-based live customer service support? All options are available, but not always all from the same broker or insurance company.

Claims processing

Research what other customers say about working with this insurer and whether the insurer serves as a client advocate when claims are filed.

Get in Touch

Contact us online, or give us a call at 1-888-852-5552 for help with all your insurance needs!

7 Tips to Keep Your Canadian Insurance Affordable

Insurance is our business, so of course we are passionate about what we do!

But honestly, in the four-plus decades our doors have been open, we have yet to meet a new client who is truly excited about buying insurance.

Insurance generally falls into the “must-have” category rather than in the “want to have” category. You know you need it and you understand the risk of not having it, so you put a line item in your annual budget and you renew your policies when their renewal dates arrive.

But if purchasing insurance itself isn’t particularly fun or exciting, imagine what it feels like to learn you have been paying more for your insurance than you need to! That is the real bummer in our industry, and one we want to help our clients avoid!

In this post, learn seven key tips to make sure you are paying a fair price for your insurance.

1. Check Your Credit and Ask Your Insurer to Do the Same

In today’s global online marketplace, where many industries now service a provincewide or even nationwide clientele, credit scores are more important than ever as a screening factor.

Your credit history and score can say a lot about how you handle money and debt. When you’ve worked hard to keep your credit score high or you have worked hard to repair your credit after a tough situation, you deserve the benefits that now affords you!

One benefit can be a lower property insurance premium. You can even pull your own credit score first, review it and clear away any issues. When it is squeaky clean, ask your insurer about credit rating and insurance—you may just earn yourself a discount!

2. Bundle Your Insurance Products

The insurance industry is heavily regulated by provincial and national laws, but oddly, this just makes the competition stiffer to win and keep new clients.

We attract and retain customers through excellent customer service. This includes looking for discounts for our customers. A perk many insurers offer is premium discounts when a customer takes out more than one policy. For example, maybe you have a home insurance policy with us, and now you want to take out an auto insurance policy as well. Or perhaps you have your auto insurance policy with us and your spouse is insured somewhere else. Let us take a look at bundling everything for you. The discounts can be substantial when you bundle more than one insurance policy together with a single insurer.

3. Find the Cheapest Way to Pay

Another easy way to cut insurance premium costs is to opt for the cheapest payment plan the insurer offers. This all relates to the insurer’s own costs of processing payments. You can pay for the year up front, or with many insurers, a three-payment option does not carry any service charge at all.

If one of these payment methods aligns with your budget it can net you a discount of 3 percent or more, without lifting a finger!

4. Review Your Coverage Annually

Your life does not stand still. You add a deck to your house. Babies are born. Kids leave for university. You swap out that old oil furnace for a new propane furnace. Your income changes. You decide to close in your swimming pool. An aging parent has moved into that basement bedroom that your university-aged son or daughter vacated. The policies that fit you perfectly five years ago may not fit who you are today. You may have new exposures that need to be looked at, or you may be paying to insure things you no longer need to insure.

You should make a point to review your insurance policies when they renew each year, and phone or stop in every few years to go through them in person with a broker. Tailoring your insurance to your current needs can sometimes deliver a surprising number of savings!

5. Increase Your Deductible

Even if you aren’t able to find any areas where you are over-insured, there may be options to raise your deductible (the amount you pay out of pocket if you make a claim) and realize cost savings.

The one caveat here is that you should not raise your deductible above the amount you can comfortably afford to pay if you do have a claim under that policy.

6. Don’t Call In That Claim

In the same way that you have to do a bit of forecasting to figure out how much insurance coverage to take out each year, so too does your insurer have to forecast to figure out how to keep the insurance business affordable for clients yet still profitable for the company.

Many insurers now offer a “claims-free” incentive or discount for clients who have not filed any claims for a specific period of time. Sometimes this incentive increases with the amount of time the client has been claims-free.

Not only is it quite likely that your next year’s insurance premium will go up if you file a claim (since this makes you more expensive to insure), but also you will forfeit any claims-free incentive your insurer is offering.

This is not to discourage you from filing claims, necessarily, but simply to say that if your claim is for something small or something your deductible barely covers, it may be worth your while to just pay that particular expense out of pocket to keep your premiums lower.

7. Adjust Your Coverage As Your Property Ages

Your auto is one of the biggest-ticket items you will ever own. But as a car ages, the cost of maintaining full insurance coverage may outweigh your actual benefits.

This can be worth exploring if you are insuring an older vehicle.

Get in Touch

Have questions or want to review your insurance coverage before you renew? Contact us online, or give us a call at 888-853-5552!